We don’t use Robo-advisers because their services can be easily replicated with zero fees by smart frugal retirement savers. Tax loss harvesting, one of the Robo-adviser tasks, is also easy to perform yourself and we have been doing it since beginning to save in taxable accounts. Of course, once we are retired, tax loss harvesting is much less useful and for some early retirees, it is even completely ineffective. Moreover, investing only a small portion of your portfolio with a Robo-adviser, and managing the rest yourself is a bad idea because, among other reasons, some of your own trades could potentially invalidate the tax losses in the Robo account.

Intro

The early retirement community seems to be quite intrigued with “Robo-advisers.” Pretty much every major blogger seems to have a link to Betterment, with a disclaimer about the participation in the Betterment affiliate program. MMM wrote a positive review on Betterment here, while GCC is extremely skeptical, see here. With all the hype about Betterment, it’s astonishing that its major competitor, Wealthfront, seems to have been largely ignored. Maybe it doesn’t offer a generous affiliate program for finance bloggers?

For full disclosure, I find that Robo-advisers are a great alternative for the general public. Not everybody is as financially savvy as the people you will encounter on these and other pages. However, for our community, i.e., people with a lot of financial sophistication and extreme frugality and discipline, Robo-advisers are the epitome of wasteful spending. With one tiny exception (Wealthfront does direct indexing with tax loss harvesting, more details in a future post) the average Robo-adviser is doing no more and no less than what a smart frugal person can perform in just a few hours of work per year.

The fees, 0.25% for both Betterment and Wealthfront, may not sound like much. But most turbo retirees target a withdrawal rate of 4%, thus, Wealthfront and Betterment would eat into your retirement to the tune of 6.25% of your annual consumption budget (0.25/4.00=0.0625). We would be talking about thousands of dollars in annual expenses. Ouch! Mr. and Mrs. ERN, yours truly, plan a withdrawal rate of only 3.25-3.50%, at least initially, so the Robos would take an even bigger toll on our spending.

How about investing only a small portion, say $100,000, out of our much larger portfolio? Mr. Money Mustache did that in 2014. That’s almost the worst of all worlds. The rebalancing in the Robo portfolio is then essentially useless because the weight drift in the other 90% will overshadow anything inside the Robo portfolio. The tax loss harvesting and rebalancing, which every serious turbo retiree should perform, takes the same amount of effort whether you do it with your 90% non-Robo portfolio or your entire portfolio. Even worse, by having only a portion of your portfolio with the Robos, you could inadvertently create disallowed wash sales because the tax loss harvesting in your Robo and non-Robo portions of the portfolio are not coordinated. Now the Robo has become a true catch 22: can’t use it on a portion of your portfolio, but using it on the entire portfolio is way too expensive.

So, what do we think about bloggers endorsing Robo-advisers? Amazing how people have become masters of frugality who ride the bicycle to Costco to save 50 cents on gas but then do a less than careful analysis on the pros and cons of the Robos. One could potentially waste hundreds, even thousands of dollars each year!

How to be your own Robo-adviser

The Robo-adviser has three main elements:

- The asset allocation

- Continuous (to a degree) rebalancing to the target allocation

- Tax loss harvesting in the taxable account while avoiding wash sales

None of these are rocket science and can be replicated easily:

How to find the target asset allocation

- Asset allocation option 1: without even investing anything at Wealthfront, you can see their recommended asset allocation after just answering a handful of questions. A big caution about Robo-advisers: the asset allocation can potentially be off depending on how you answer their questions. At age 25-35 they put you in a lot of stocks. But tell them that you are retired or close to retirement, and you might end up with 70% bonds. Be careful what you answer because their programs are calibrated to the average worker who retires at age 65, not the turbo retirees like us! Luckily, you can manually adjust the Wealthfront risk tolerance (values between 0.5 to 10.0 in 0.5 steps) and for the accumulation phase, we would probably be in the 9.0 to 10.0 range, not at all where the algorithm wants to put you. Currently about 90% stocks, 10% bonds.

- Asset allocation option 2: look up the asset allocation of the typical target date funds (TDF). The largest providers of those funds are Vanguard, Fidelity, and T. Rowe Price. Very important, the retirement dates are totally meaningless for us, we merely use them to gauge the appropriate allocation for a desired risk level of the portfolio. So even though we like to retire in 2018, we ignore the bond-heavy 2020 TDF, but rather check the max risk fund, e.g. the Fidelity 2060 TDF, see here, currently 63% domestic equity, 27% international equity, 10% bonds. (Incidentally, the identical S/B allocation as Wealthfront!) Probably, all years between 2045 and 2060 have a very similar, if not identical allocation. If you think that’s too much equity exposure, just move back to the 2035 or 2030 TDF allocation.

- Asset allocation option 3: pick a number, any number for the equity allocation that you felt comfortable with when doing the simulations at cFIREsim, likely between 70% and 100%. Put that share into a total stock market fund, the remainder into a total bond market fund and that’s it!

- Implementation: Keep the following assets in the tax-deferred accounts: bond funds, REITs and high dividend equity funds. Keep equity funds in the taxable accounts. Check how much in foreign tax credit you can claim on the foreign ETFs (tax credits make those funds more attractive in the taxable account), but also how much they pay in dividends. European stocks have higher dividend yield, which makes them better suited for a tax-deferred account. Use the equity funds (likely the lion’s share in your target allocation) to fill up the remainder of the tax-deferred accounts because the bond and REIT funds likely don’t fill up the tax-deferred accounts.

- To save on trading costs during rebalancing and management fees in general, it’s best to hold the bulk of your assets in low-cost index mutual funds at Vanguard and/or Fidelity or use the low-cost index ETFs that one can trade commission-free at Vanguard, Fidelity, Schwab and other brokers. Note that the ETF trades are still subject to a bid/ask spread, so even without a commission, there is a cost. So, I like mutual funds that can be exchanged from one fund to another at the final daily NAV, for any dollar amount I specify.

- Important: for all mutual funds in the taxable account, switch off the automatic dividend and capital gains reinvestment feature. This is important for the tax loss harvesting, to avoid potential disallowed wash sales. Instead, deposit the proceeds into the cash account and reinvest according to the rebalancing rules below. Also, for all mutual funds in the tax-deferred accounts that have an identical fund in a taxable account, switch off the auto reinvest feature. For REITs and bond funds that are exclusively in tax-deferred accounts, you can keep automatically reinvesting the dividends.

Rebalancing and Tax loss harvesting:

- Approximately 4 times a year, check your asset allocation. You might pick the dates to coincide with the dividend payments of the large index fund holdings you have, say Mar/Jun/Sep/Dec of every year for VTI. During extreme market volatility, you might check as well and see if any position has dropped and can be harvested

- For each holding in your taxable account, look at the various tax lots. If any of those lots display a loss, sell them, but make sure that the identical fund hasn’t been purchased in the last 30 calendar days.

- You can write off up to $3,000 from your ordinary income (i.e. wage income) per tax year, taxed at up to 39.6% federal and around 10% in the high tax states. If you have more than $3,000 in one year, you can roll over the remainder and write off $3,000 in each future year.

- Long-term losses are first netted with long-term gains but any net loss could still add to the amount you can deduct from your ordinary income, up to $3,000 per year. Any leftover carries over to future years. So, definitely, you also want to harvest long-term losses!

- Use the proceeds from selling the losing tax lots, dividends, and new contributions to purchase the asset classes that are now underrepresented in your portfolio, relative to the target allocation.

- To avoid wash sales, we don’t want to do buy “substantially identical” funds from the ones we sold. For example, we don’t replace IVV with SPY. They may not be identical but they track the identical target index. Replacing IVV with VTI is probably still safe, though Michael Kitces points out that even this exchange gets pretty darn close to substantially identical. So far, however, the IRS has not cracked down on any wash sale abuse. I haven’t even heard of cases where selling IVV and replacing it with SPY ran afoul with the IRS, but I don’t want to tempt faith and become the first target when the IRS finally starts acting.

- When assets are underrepresented in your portfolio, relative to the target weights, it’s easy to proceed. Just purchase more. However, if the weight of a particular asset class has drifted too high, things get more complicated. If we can sell inside a tax-deferred account to bring the weight down to the target, we do so. If assets that we own in a taxable account (and only there) are over-represented, things get more complicated. You could sell the tax lots with the lowest long-term gains to reduce the weight. If you are already in retirement, that might be the best way to fund your expenses anyways. If you are not yet retired and the long-term capital gains are likely taxed at 15% or higher rates, it might be best to keep the overweight for the time being. New money coming in and reinvested dividends from the taxable account will flow into the other asset classes and you may over time simply grow out of the “problem.” Differences of 2-3% between target and actual weight are small enough to not really worry about.

- Another issue to keep in mind: Make sure that the new fund you are purchasing in the taxable account doesn’t distribute another dividend within 60 days. Specifically, buy new mutual funds or ETFs 61 or more before the next ex-dividend date. Otherwise, that one dividend (but not future ones) will be considered non-qualified and taxed at the higher personal income tax rate rather than the lower (potentially zero) dividend tax rate.

Some strategies to avoid wash sales

- For each asset class that you hold in your taxable accounts (likely 3 major equity classes: domestic, developed non-US, emerging markets), keep a list of a few low-cost index funds that are highly correlated, but not identical. If you have to sell one fund for a tax loss, buy the other one that same day. Here we put together a table of funds. Thus, the funds are not substantially identical, but extremely highly correlated.

- Even if you like to stay within mutual funds of the same provider, say, Fidelity, you can replace FUSVX (Fidelity S&P500 Index) with FSTVX (Fidelity US Total market) or vice versa. They are still very highly correlated, even though the FUSVX is missing all the mid and small-cap stocks.

- Another technique is to replace a broad index with its subcomponents (though in their correct ratios). Example: you see your non-US developed ETF (Ticker IEFA) underwater, realize a tax loss and replace it with the ratios of currently 24% for a Japan ETF, 7% Australia ETF, and about 69% developed Europe ETF.

- The larger the tax lot you sold for a loss (relative to total portfolio size), the more important it becomes to replace it with something very correlated (though not identical). Example: At the bottom of a recession replace a big chunk of underwater VTI with ITOT. If on the other hand, the tax lot in question is small because the bulk of your investments from years ago has no tax loss, only the most recent dividend reinvestments are underwater, then don’t sweat finding anything super-correlated. By all means, replace the small domestic equities lot with international equities. You can always correct the small drift in weights with future contributions and dividend reinvestments. This also prevents “balkanization” of your ETF/mutual fund holdings, where you hold 5 or 10 different US equity ETFs from all the different tax loss transactions over the years.

- For regular contributions into tax-deferred accounts, invest in asset classes and funds not currently represented in your taxable accounts. This avoids inadvertently buying something in your tax-deferred plan that would invalidate a future or past tax loss sale. So, in the tax-deferred accounts, purchase a bond fund and/or a high dividend equity fund (VYM or VIG) that you will never own in a taxable account. If you create a bit of weight drift during the quarter, you can always rebalance at the midpoints between the quarterly tax loss checkups. That way you’d be 45 days away from each potential tax loss sale, so no issue with wash sales. Or do the rebalance on the quarterly tax loss checkups, but be mindful and not buy anything that was sold for a loss that day.

- For regular contributions into taxable accounts, be cognizant about the upcoming rebalancing and tax loss harvesting. If some of your current holdings are close to or at a taxable short-term loss, stop reinvesting fresh money into those funds and invest in other (not substantially identical) low-fee funds 30 days before the next tax loss harvesting.

Tax Loss Harvesting example:

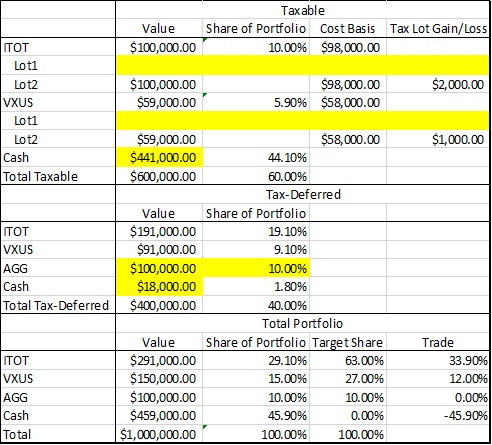

Assume that we have a target allocation of 63% domestic stocks, 27% international, 10% bonds (roughly the Fidelity 2060 Target Date Fund). The total portfolio value is $1,000,000 including $28,000 and $13,000 cash positions (from new savings and dividends) in the taxable and tax-deferred accounts, respectively. Notice that ITOT (iShares total stock market fund) and VXUS (Vanguard ex-US equity) each have one large tax lot with a loss. We don’t display the cost basis in the tax-deferred account because tax loss harvesting is possible only in the taxable account. Also, notice that the bond fund in the tax-deferred account is above the target weight:

Step 1: Sell the tax lots with losses in the taxable account for cash and the excess bond portion in the tax-deferred account. Notice that the US equity weight is now 33.9% below the target and international equity is 12.0% below target:

Step 2: Purchase $339,000 worth of SCHB (Schwab total US stock market fund, with different benchmark index, thus, not a substantially identical security), of which $18,000 go to the tax-deferred account and $321,000 in the taxable. Next, buy $120,000 worth of IXUS (iShares ex-US equity fund, with slightly different benchmark) in the taxable account. Notice that in the tax-deferred account we also have to buy the new fund SCHB. We should not buy ITOT here, otherwise, we would invalidate part of the tax loss in the taxable account:

These trades would have created $32,000 worth of short-term losses that can be netted against ordinary income, up to $3,000 per year (rolling over the unused portion into future years)!

But isn’t the Robo-adviser more efficient, by monitoring and rebalancing daily?

If quarterly rebalancing is too slow for you, you could also go to monthly. You don’t want to go to a much higher frequency because you may not have enough highly correlated assets that you can use to replace tax losses. Say, Monday you sell your S&P500 Index fund to realize a tax loss and buy a Russell 1000 index fund. That one drops on Tuesday, thus, you realize a short-term tax-loss again by selling and replacing it with a total stock market index fund. If you keep doing this daily, you may quickly run out of highly correlated low-cost ETFs to pick from. Remember we cannot buy the fund (or substantially identical investment) that you previously sold, or the prior tax losses could be invalidated. By the way, Robo-advisers are facing that same problem; they too will not trade on every single day to scoop up all the small tax losses for the exact same reason.

Another reason against faster trading: some mutual funds charge extra fees for trading in and out too quickly (usually 90 days). ETFs have trade commissions, and even the ones you can trade commission-free, have the hidden trade cost called bid-ask spread.

Also, faster rebalancing doesn’t always mean better results and sometimes yields worse results, even before transaction costs. Rule of thumb: faster rebalancing helps you during choppy markets without direction and fairly quick mean-reversion, e.g., 2015/16. But fast rebalancing hurts you in markets with strong momentum (up or down). For example, during a long bear market, you don’t want to sell bonds to reinvest in stocks when stocks are falling every month. You are trying to catch the falling knife. Let the equity losses pile up for three months and then rebalance.

So, unless you know what market environment you are in, you might just relax and not stress out about monthly or even faster rebalancing. If you still have a day job, why spend more time than you need to? If you’re retired, enjoy your life!

One final note on tax loss harvesting

Tax loss harvesting has the biggest impact when

- Your current marginal tax rate on short-term capital gains is much higher than your projected tax rate on long-term capital gains when you eventually realize them.

- The time of realizing those long-term gains is many years in the future.

Roth Conversions:

Towards the end of the year, figure out how much your ordinary income falls into the safe zone comprised of your standard deduction plus exemptions; in 2015, that’s $12,600 for married filing jointly plus $12,000 for a couple with one kid, equal to $24,600. If you had less ordinary income, do a Roth conversion to generate enough ordinary income to fill up that amount. Go Curry Cracker has a nice actual example on this, see step 6 of their “seven-minute tax” calculations.

Tax gain harvesting:

Once we are retired we should live in a no-income-tax state and fall into a low enough federal tax bracket that all long-term gains should be taxed at the 0% marginal rate. If towards the end of the year, say at the December rebalance, we realize that our YTD is below the 15% federal bracket, we sell more assets in the taxable accounts with long-term gains to fill up the 15% bracket, where capital gains are not taxed at all. Use the proceeds to buy a similar, though not “substantially identical” funds, as above. We have now created a higher tax basis for those funds and lowered our future tax bill, without any impact on this year’s taxes!

A General rule for selling assets in taxable accounts:

Liquidate assets, if you must, in the following order: 1: short-term losses, 2: long-term losses, 3: long-term gains, 4: short-term gains

Disclaimer

This blog post and all the others are purely for entertainment purposes. Please read the Disclaimers again, just to be sure! Consult an accountant before you implement anything we wrote here.

With tax gain harvesting, you don’t need to buy a different fund. The wash sale rule doesn’t apply–you can repurchase the same fund. One less thing to keep track of! See for details: https://www.bogleheads.org/wiki/Tax_gain_harvesting

Yes, good point. The whole apparatus about buying different funds we laid out above is only for tax LOSS harvesting. Declaring gains, the IRS seems to be happy if you buy the same security again.

Thanks for stopping by!

Really love this post. I am finding a passion and love for personal finance and investing. I recently left our financial adviser to go out on my own after I saw he was charging me 5.77% per purchase! Luckily, I only used him for one year. He was a great help getting me started, but after I figured I could do this on my own for .1-.05% I was like See YA! And excitedly started the journey to learn. This article really helped open the door for me to continue my learning and build my style. Thank you and I’ll come back. Come check out what we write about @ wealth well done . com Thank you!

Thanks Bill! Geez, that was ripoff with the adviser. The 5.77% was probably a front-load for mutual funds and he pocketed most of that. No need for that kind of nonsense now. DIY and save tons of money on fees.

I will check out your site: http://www.wealthwelldone.com/

By the way, no need to hide links around here. Everybody has not one but two (!!!) free links to share before anything gets filtered out. 🙂 Do as much blatant advertising for your blog as you want, haha! That’s how we all find new interesting blogs!

What have you done to learn more? My biggest struggle is understanding how to rebalance and be able to do it on my own.

Hey Becky, I’m not sure if you’re talking to me here, but here is an article I wrote about the process I took to learn how to do it on my own. The article should give you a good start to start doing it on your own. Master Money and Investing: Ninja and Jedi Wealth: http://www.wealthwelldone.com/master-money-and-investing/ Thanks!

Great article! Highly recommended. May the Force be with you all!

#jedifinances

In retirement accounts you could use a Target Date Fund. It re-balances automatically. In taxable accounts I would use caution with too much re-balancing. You might generate taxable gains. But maybe just direct new investments into the asset classes that are underweight? that’s a start!

Hey thanks ERN! You know, I’m just so grateful that I caught those fees after the first year and not let them get out of control and dependent on them for the next 30 eyars. I’m not going to get mad at the adviser. I mean, he was alot of help to get us started and learn more about investing. I’m just glad I kept on looking around on my own and learned the TRUTH about investing and advising. I looked back on the 22K we invested last year and those fees look hideous now. 5.77% for both my wife and I’s Roth IRA (11K) and another 11K in front loaded taxable mutual funds . Then I looked at the annual maintenance fees on them and they were like .88-1.21% ICK! So glad I found the truth and got out and got into vanguard with my one .05% annual fee! We actually met with him again this week to discuss our 2016 and 2017 goals. I brought up the fee question to him, and showed him some comparable vanguard funds. He actually said, “My target clients don’t think like you do. They just want to work hard at their job,and let an advisor keep them disciplined and in the market. If you want to go out and learn to do it yourself, then go for it.” We dumped 31K in the market this last month and it felt liberating to start watching my money grow on day #1 rather than waiting 6 months or a year to pay off the sales charge. I can’t wait to learn more as I go on my own. I’m just so glad I questioned those fees, rather than just went with them like they’re part of a necessary evil for the next 30 years. ICK! Since you’re cool with dropping links, here’s a great article to start with as it tells the story of how I felt lost with money and investing, and how I began my journey to learn and take control of my investment future. The biggest step is having the desire to learn, and taking the risks necessary to learn.. http://www.wealthwelldone.com/money-and-investing/ God Bless!

Wow, thanks for sharing that awesome (though costly) experience. Cheers and God Bless you too!

You just made my day 🙂 I am a newbie investor … in November, 2016 I opened Betterment account to start some kind of investing since I just started learning about investing and stopped contributing to my 401k ( no company match, 1-1.3% mutual fund management fees). 2-3 months of education and with my new goal of becoming financially independent in 15 years I want to go into Vanguard. I still have so many questions but your blog luckily answered most of them. I still have a few.

I asked about switching from Betterment to Vanguard yesteday at Rockstar Finance Forum and your blog post/manual showed up in my email today (I see it as a sign and blessing from the universe),

Question;

I I only have $750 in Betterment’s Traditional IRA But I would like to roll it over to Vanguard. How do I allocate my investments ? Do I get high yield bonds and no equity in it?

I also have HSA which will qualify for investment once I reach $2100 which is soon. Do I get into bonds and not equity since its tax sheltered account also ? What should be my allocations there?

I have about $5000 taxable account with Bettermtnh with 90% and 10% allocation. I want to roll it over to Vanguard and would you recommend similar allocation with ETFs? 90% in total stock market and 10% in total bond market ?

I want make educated decisions since the beginning of my journey 🙂 and I will use this post of yours as my Financial Independence Investing bible for future reference also 🙂

Thank you so much again. You don’t know how much it means to me to find this post.

Oh thanks! You made my day!

For relatively small accounts Betterment probably isn’t such a bad idea. I would try to grow the IRA a little longer and then transfer to Vanguard. Many providers charge you a low-balance fee if you don’t have at least several several thousand dollars.

For the taxable account I would make sure the transfer is in-kind and doesn’t trigger any capital gains. That solves the allocation issue: you end up with the exact same as you had in Betterment. 🙂

So simply move the exact ETF shares over to a taxable account.

But the same caution applies here: For small accounts, say <$20,000 Betterment might still work because they do the trades for free while doing the tax loss harvesting yourself you'd pay a commission every time.

Good luck!

Thank you so much. After reading a little more today I decided to grow my IRA and my taxable account. Although I do have $3000 cash I could invest in Vanguard’s one fund. Should I invest It total stock market fund?

Total Stock Mkt fund sounds like a great option!

Thank you. I will give it a try 🙂 I appreciate your help.

Good luck! Let me know if this works and makes sense!

Cheers!

Thank you 😊

the link for a list of funds to avoid a wash sale doesn’t work (https://earlyretirementnow.com/2016/03/29/list-of-index-etfs-and-mutual-funds/). any way to get that working again?

Thanks for pointing this out!

For some strange reason WordPress changed the link address

The correct one is:

https://earlyretirementnow.com/2016/03/28/list-of-index-etfs-and-mutual-funds/

It’s 03/28 not 03/29. Strange!

Please let me know if you find any other defunct links!

Thanks!

ERN

Dear ERN, what is the reason for using an intermediate step of a cash account instead of directly buying a new fund by selling the fund that had a loss?

You could also buy a new fund as long as that fund is not on the “sell” list for +/- 30 days. I just want to make sure that no fund subject to TLH ever reinvests the dividends automatically. Some brokers have the setting where you can reinvest in the same fund, reinvest in a different fund or simply pay out cash.

Karsten, how does one work out when the benefit of tax loss harvesting outweighs trading costs? The cheapest broker I have access to charges $9.50 per trade, I’m assuming that the first hurdle is the marginal tax on the amount saved/deferred has to be greater than trading costs.

Then does one have to bring time value of money into it to work out if it was worth it?

I think the bar is pretty low. Your tax benefit is the tax loss times the difference between the two marginal tax rates (today vs later). I’ve done TLH for as little as $100 vs. a 2 times $5 commission (two ways!).

Are 401(k) plans excluded from wash sale rules? IRS Pub 550 seems to declare that only IRA’s are considered with wash sales.

Do you have a reference from the IRS that explicitly states that 401k plans are excluded? If not, it’s safe to assume that wash sale rules apply to all of your accounts. I found this reference:

https://www.mysolo401k.net/wash-sale-rules-apply-to-solo-401k-plans-and-iras/#:~:text=This%20Revenue%20Ruling%20states%20that,before%20or%20after%20the%20sale.

And this tax expert says that OF COURSE the IRS will also consider 401k plans:

“While IRS Revenue Ruling 2008-5 December 21, 2007 references IRAs, it is safe to say that this ruling also applies to solo 401k plans as is most often the case.”

And unfortunately, this 401(k) plan doesn’t allow participants to switch off the auto reinvest feature.

Depends. I have a large cap index fund in my old 401k that reinvests dividends internally. You don’t even see any dividend payments. If I stop contributing to that fund and the dividends are credited without showing up on my statement I should be safe. 🙂

So it depends on the setup in your account.

Yes! It’s just like you described, on my plan also. The dividends are reinvested internally in both funds, large cap and international. I don’t see any dividend payments. That helps. Thanks for the tip!

I have no idea that what can I say about it. Blog writer does a great job by spreading that good thought.

It was mentioned in here that you’ll have a future article about wealthfront’s direct indexing. Has that article been written yet? I’m curious since the tax loss harvesting opportunities from direct indexing seem like they provide a lot of value to someone in the accumulation phase.

Haven’t put much thought in it. Thanks for the reminder.

Hi Big Ern,

Thank you for all of your valuable insight and information. I’m just starting out tax loss harvesting and have a question for you that I haven’t been able to figure out on my own:

I’m attempting to tax loss harvest before years end (2022), but am discovering any of the similar funds I could move to (from FSKAX, around $9k in losses – was thinking moving to FZROX) seem to distribute dividends at years end (whether quarterly, semi, annual…) Which means that if I invest now (mid Nov.), I will be within 60 days of a distribution.

However, we know we will have a larger bill coming up from the capital gains of selling an investment property that we can limit by lowering our basis with the $3,000 (we’re right at the edge between brackets…). What would you advise here?

Realizing now, I should have made the trade end of Sept, but I imagine most stocks gives dividends in Dec, so I can see this being an issue in the future. Does that mean trading can really only happen for tax loss harvesting before mid Oct, and not later, to avoid that one dividend distribution being taxed at a higher rate? Or is that caveat less important than trying to realize the tax benefit from the loss no matter the time of year and dividend distributions?

I would love your feedback on what you might suggest for us personally, and how that caveat should be taken into consideration in the future. Thank you!

Dividend yields are pretty low now, so it shouldn’t make too much of a difference.

I hold both funds. It looks like the FZROXusually pays in early December. (Dec 3 in 2021) and FSKAX pays a week later. At least they did so in 2021. Can’t you just sell the FSKAX after the FZROX dividend date but before its own dividend?

Also, both funds pay dividends, so I don’t see the problem from a TLH perspective. You want to make sure that you own the fund for at least 31 days during the window 30 days before and 30 days after the ex-dividend date, so you enjoy the “qualified dividend” status. Apart from that I don’t see any challenges of TLH in the last few weeks of the year.

Thanks for that feedback. All valid points and I appreciate the clarification and insight! Sounds like I will miss out on the end-of-year dividends for both funds if I trade between their distributions, correct? No big loss, but want to make sure I’m understanding that correctly.

No, you don’t miss out. The price will move on the ex-dividend date to compensate for that! 🙂

So, again: you’d be better off avoiding the dividend: you get the same returns but less taxable income this year! 🙂

Great! I will trade between their dividend windows and be happy all around! : ) Thanks again for you help – I appreciate it!