Almost everywhere in life, the word “active” has a positive connotation. An active lifestyle, an active personal life, an active participant in a discussion, etc. In contrast, “passive” stands for low-energy, dull and boring. Imagine setting up a friend on a blind date with a nice gal/guy who has a really great “passive lifestyle” and see how much excitement that generates.

But investing is different. Passive investing is the rage right now! It is a noticeable market trend in finance overall and the Financial Independence blogging world seems particularly subscribed to the passive investing idea. For the most part, I agree with the superiority of passive investing. But then again, not all active investment ideas are created equal. And that means that we are at risk of throwing out the baby with the bathwater!

Has the Personal Finance Passive-Pendulum swung too far? Are we willfully ignoring some useful principles from active investing for fear of shaking the foundations of the Passive Investing Mantra?

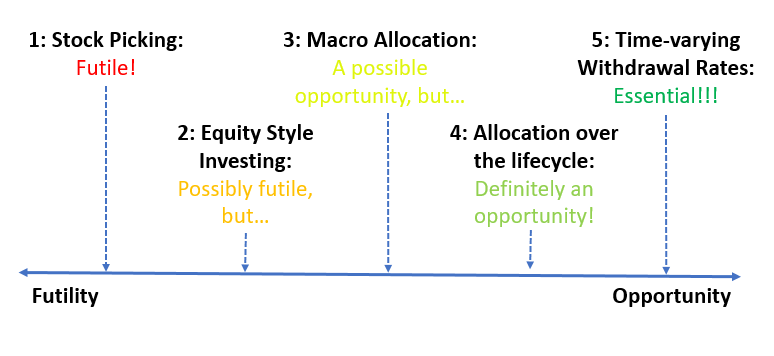

Take the following five examples of active investing. They all fall into different spots on the Futility vs. Opportunity spectrum:

- Stock picking.

- Style investing, i.e., tilting the portfolio toward a theme such as dividend yield, small stocks, value stocks, low volatility stocks, etc., or a combination of them.

- Allocation to different asset classes (e.g. stock, bond, cash, alternatives) in response macro fundamentals (P/E ratios, bond yields, volatility, etc.).

- Changing the major asset weights over the life cycle, e.g., using an equity glidepath to retirement and even throughout retirement.

- Setting the initial safe withdrawal rate in retirement and all subsequent withdrawal rates in response to changing market conditions.

It would be a mistake to apply the same passive investment mantra to all five aspects of personal finance. So, that’s what today’s post is about: Where should we stay away from active investments and where can we learn something from active investment principles? Let’s look at the five active investment themes in detail…

1: Stock picking – Futile!

The way I usually rationalize the futility of stock picking and the superiority of indexing is the following simple line of reasoning:

- All equities in a specific stock index are exactly weighted by their capitalization. By definition!

- If we split all investors into active and passive, then note that passive investors hold their investments in exactly market cap weights, by definition.

- If you start with market capitalization weights for the index and take out the chunk of passive investors who hold their stocks according to market cap weights then the remaining active investors, in aggregate, have to also hold exactly the market capitalization weights!

So, individual active investors can outperform the index but in aggregate, all actively managed portfolios can only track the index.

And, of course, once you take into account trading costs and expense ratios for actively managed funds they will likely underperform. Now, supporters of active management can argue that not all active portfolios are created equally. Maybe there are lots of unsophisticated investors. Suckers who will consistently underperform and serve as cannon fodder for the smart investors. But I doubt there are enough suckers out there to provide the excess returns for overcoming active management fees or the value of my personal time to perform the analysis myself. I’m a passive investor in that sense and recommend everybody I know to do the same.

2: Style investing – probably futile, but…

A variation on the stock picking theme is to deviate from index weights, but doing so in a systematic way. Think of this as tilting the weights of the portfolio to overweight certain styles that – hopefully – outperform over the long-run. Two prominent examples: Over the very long-term, both small cap stocks and a value stock tilt (stocks with a high book to price ratio) would have outperformed the market overall, see data from the Fama-French Factor database below.

It was a bumpy ride for the small stocks factor for the last 35 years or so. The blue line has been flat since the early 1980s, indicating that a small stock bias has not outperformed the overall index since then. The Value tilt was a bit more consistent for about 80 years and has outperformed the cap-weighted index from 1926 to 2006. But for the last 11 years, value lagged behind the index (orange line flat to slightly down).

Another popular tilt, especially in the FIRE crowd, would be overweighting dividend stocks. Some people swear by it. See Ten Factorial Rocks, Tawcan and many others. I have thought about dividend and dividend growth investing myself but never actually pulled the trigger. My concern is that styles go in and out of fashion and any excess return we might have observed in the past can quickly be arbitraged away in the future, especially considering the growing specialty ETF industry that jumps at the opportunity of offering the next hot style.

So, what’s the verdict? Sure, the value and small-cap premium might come back. Dividend stocks might save you during the next downturn. I wish all style investors the best of luck but personally, I’m not “buying it,” neither figuratively nor literally.

3: Macro Asset Allocation – a potential opportunity, but…

OK, so picking individual stocks is hard. It’s so hard that retail investors, even those with a finance background like yours truly probably want to skip this and just stick with an index fund. So, let’s look at the most die-hard Boglehead who invests x% in a global equity index fund and 100-x% in a bond fund. Is it wise to keep the target weights the same all the time? Regardless of bond yields and equity valuations? I would argue that it’s not. Nobody could have said it better and more succinctly than Warren Buffett:

“Be fearful when others are greedy and greedy when others are fearful”

Expected returns of different asset classes vary over time. I can make this case easily for bonds where, in the case of default-free U.S. government bonds, we can even read off the expected return over the remaining life of the bond. It’s the yield to maturity, e.g., currently about 2.3% for the 10-Year Treasury. That yield has fluctuated over the decades from the low 1% during the aggressive Federal Reserve accommodation to well into the double-digits in 1979-1985. But even expected equity returns vary over time. They are a lot harder to measure, but some smart folks have weighed in on that discussion:

- Jack Bogle recently pointed out that he expects only about 4% nominal returns over the next 10 years for equities.

- Another icon of the passive investing world, Burton Malkiel, author of the investing classic A Randon Walk Down Wall Street pointed out last year that equity returns may be a bit leaner going forward. (Oh, how much it pains me to link to a Wealthfront blog entry! Readers of this blog know about my opinion of the Robo advisers. Remember, we saved $42,000 by not moving money to a Robo adviser?!)

So, two of the heroes of the passive investment world, Bogle the practitioner and Malkiel the legendary finance professor, point out that equity returns will be a bit lower than usual. What should we make of this? Have these two icons of the passive investing world suddenly changed their decade-long held beliefs? Have they fallen off the wagon? Of course not. Time-varying equity expected returns are neither at odds with Bogle’s idea of indexing nor Malkiel’s Random Walk hypothesis. Remember, the stock market is, mathematically speaking, a random walk with drift (to account for the positive expected return). Bogle and Malkiel simply pointed out that the drift rate can change due to changing valuations (e.g., P/E Ratios, CAPE ratios, etc.).

Notice that Bogle and Malkiel don’t argue for selling all your equities and running for the hills. Neither do I. Bond yields are also low, remember? Actively timing the Stock vs. Bond allocation isn’t trivial. Looking at equity valuations only, you’d run the risk of getting out of equities too early; Shiller’s CAPE went above 30 in 1997, years before the equity market peak. Likewise, you could get back into equities too early; equities appeared cheap again in late 2008, months before the actual market trough in March 2009. But being cognizant about today’s underwhelming equity return expectations and watching out for the next inevitable excesses of greed (for full disclosure, I don’t believe they have arrived yet), and the subsequent period of excessive fear, will be a prudent move. But don’t call me an equity bear! Forecasting the next bear market is a futile exercise as our blogging friend Physician on FIRE pointed out just yesterday. But I admit that I have shifted a portion of the ERN family portfolio into alternative investments such as real estate and options trading in response to the poor equity and bond expected returns.

What about the recent JL Collins “time machine” post?

JL Collins had a nice post about the 1975-2015 episode showcasing all the different obstacles the stock market has overcome in that 40-year window. Also check out the excellent ChooseFI podcast featuring some of the same discussion. Does that deny the Bogle story? Quite the contrary. It actually confirms the whole valuation-based expected equity return narrative. In other words:

1975 was a great year to start investing in equities, not despite the macroeconomic woes, but exactly because of the business cycle trough in early 1975.

Specifically, 1975 was exactly one of those times with a lot of “fearful” investors mentioned in the Buffett quote. Unsophisticated investors got scared out of the market and caused the attractive, bargain-basement equity valuations with a Shiller CAPE of only 10. If you had the stomach to invest in equities and ignored the naysayers back then (JL Collins did, good for him!) you were in for a very profitable, albeit bumpy ride.

So, depending on how one interprets the Collins post I would either wholeheartedly agree or vehemently disagree with the conclusion:

- If the message is that the U.S. economy has shown great resilience during the last 42 years I wholeheartedly agree. Just like JL Collins, I am generally bullish on the U.S. economy and U.S. stocks and it’s nice to keep in mind JL Collins’ list of disasters that were unable to derail the economic expansion and strong equity performance. This post will come in handy when folks get weak-kneed following the next big drop in the market!

- If someone argues that we should disregard the Bogle/Malkiel expected return estimates because stocks performed well after 1975 and today’s economic fundamentals appear a lot better than in 1975, then I’d have to disagree. This is precisely the faulty logic of the unsophisticated investors who overreact to cycles of fear and greed, as mentioned in the Buffett quote. The prospects of good equity returns in today’s environment (300%+ equity rally, 8 years into an economic expansion, CAPE at 30) is actually worse than at the beginning of a new expansion in 1975. Now, if you think that I ignore the economic environment, I’m not; I have a Ph.D. in economics and I eat, sleep and breath economics. The forward-looking economic conditions, namely, the prospects for strong GDP growth right after the recession ended, strong earnings growth and earnings multiples expansion due to the low initial CAPE all looked very attractive in 1975. Not so much in 2017.

So again, I am not saying that the U.S. economy will falter. Don’t buy gold coins!!! I’m just saying that today’s conditions (a CAPE three times as high as in 1975) look less conducive to strong future equity returns than in 1975. Prepare for a continued bumpy ride over the next 10 and likely 40 years with slightly lower expected returns than over the last 40 years!

4: Strategic Asset Allocation over the life cycle – a big opportunity

Even the most passive investors have to make one active decision: What’s the initial asset allocation. Take the Boglehead two-fund portfolio again: global equities and U.S. bonds. What should be the percentage of the two index funds? And should that asset allocation stay the same over the entire life cycle? Research has shown that the asset allocation should ideally change over the life cycle, even completely independent of the changing equity/bond valuation landscape. The following two results hold even in pure Monte Carlo simulation simulations with Random Walk returns and constant expected asset returns over time:

- During the accumulation phase, start with a high (even 100%!!!) equity share but then scale down the equity share and increase the bond share as you approach retirement. Also known as the Equity Glidepath.

- During the withdrawal phase, the equity share should rise again. That’s not a typo! Wade Pfau and Michael Kitces wrote an excellent research paper on this topic. Yours truly also pointed out in Part 16 of the SWR series that an increasing equity allocation (80/20 moving to 100/0) is quite well-suited to making it through a hypothetical Bogle-low-return scenario for the next 10 years. I also did extensive simulations in the SWR series post on Prime Harvesting (Part 13) and showed that the success of the Prime Harvesting method in retirement comes mostly from the glidepath feature inherent in Prime Harvesting.

The reason for all of this is, you guessed it, Sequence of Return Risk (see our SWR series Part 14 and Part 15). In the accumulation phase, you shouldn’t worry much about risky investments early on when your portfolio is small. The percentage risk may be high, but the risk measured in dollars is low. But it’s best to take some risk off the table when approaching retirement with a large portfolio. Likewise, in retirement, you want to have a bond cushion early on to hedge the sequence of return risk, but then a higher equity share later in retirement, especially when facing a 50+ year horizon. Being a completely passive investor with a fixed asset allocation throughout your entire life you wouldn’t do horribly but you could likely improve the risk vs. return trade-off with a more active asset allocation. See our post on Equity Glidepaths in Retirement!

5: Dynamic Safe Withdrawal Rates – a necessity

I have written about this topic extensively. Forget about the 4% Rule! It’s should be called the 4% Rule of Thumb! Specifically, withdrawal rates should actively respond to economic fundamentals (in addition to idiosyncratic factors):

- The initial safe withdrawal rate is clearly a function of equity valuations, as we showed in Part 3 of the SWR series. If the Shiller CAPE is around 30 then a 3.25% SWR seems prudent. If the CAPE is around 10, by all means, go to town and withdraw 5% or even 6%.

- The subsequent safe withdrawal rates should respond to subsequent changes in valuations. Ideally, a CAPE-based rule, as showcased in Part 11 would do the trick. One way or another, we will all respond to changing market conditions. Even without the CAPE-based rule, retirees will eventually resort to a Guyton-Klinger-type rule (see Part 9 for details). That’s because no retiree will ever literally run out of money. Once a $1,000,000 initial portfolio is drawn down to $600,000 or $500,000 or certainly at $400,000 any sane retiree would adjust the withdrawal amounts.

Conclusion

I hope I didn’t offend too many folks in the passive investing community today. If I did, remember we probably have much more common ground than disagreement! Thanks!

Agreed! Thanks for this primer on a few best investing options. 😉

Whew! I’m glad I didn’t step on everybody’s toes this morning! 🙂

Thanks for stopping by!

Intriguing post! Even if you assume the stock market is a random walk, straight out of a Monte Carlo random number generator, then the varying bond yields should induce you to at least think about a varying stock/bond allocation, right?

Ha, good point! That’s a brilliant and simple way to make that point! Thanks for stopping by!

Where would you put Tactical Asset Allocation in your spectrum? Using things like momentum compared to a risk-free asset or moving averages as a trigger to enter or leave certain indexed markets? Such as: 1) Gary Antonacci’s Global Equity Momentum (picking best recent performance from all world ex-US, S&P 500, or risk-free return (if S&P/all world ex-US are both below risk-free, invest in Agg Bond) or 2) Meb Faber’s Global Tactical Asset Allocation (more complicated, but breaking down the main assets into smaller components)

A good summary of some different approaches (ignore the Quantitative Investment portfolios) has been collected by Paul Novell – http://investingforaliving.us/portfolios/

And a comparison of performance: https://i0.wp.com/investingforaliving.us/wp-content/uploads/2017/01/CAGR.jpg

It isn’t a fixed equity% and 100-equity% in bonds like you mentioned in Macro Asset Allocation. It is more of a responsive portfolio that would generally be equity heavy (based on normally higher returns from equity than less risky bond assets) but also responsive to equity drawdowns to limit losses.

I find Tactical Asset Allocation is a great opportunity, but with some huge limitations. Valuation usually gets the timing wrong (sell equities too early) and momentum can get you whipsawed (potentially sell at the bottom right before the turnaround). Hence the label “opportunity,

”

All of the strategies floating around on the web have potential data-snooping biases, i.e., people calibrate their models after the fact to fit the data. Doing this right in real-time, without the benefit of hindsight is quite difficult. In contrast, the folks who have been running this with real money and a long track record will likely not reveal their special sauce.

Also, a fixed % portfolio that’s rebalanced periodically, certainly has some degree of valuation already built in: You rebalance from the high performers to the low performers.

Great post! I just listened to the recent Jeremy Grantham interview on Charlie Rose. He gave some new color on today’s high PE in US equities (he’s not a buyer but not as concerned as some of his peers). He points to emerging markets equities as an attractive asset class right now with a PE of 10! He highlights that that PE hit a low of 11 at the 2009 bottom. Anyway, you mention Big Ern that you’ve shifted more of your personal allocation to real estate. I’d love to hear you expound on this strategy as it is what I have done and I feel it gets little air time in these FIRE circuits (especially at the level of sophistication with which you are able to share at). In my experience with real estate, I have come to believe that I can pretty safely count on consistent annual (not average annualized which is a lot different in the withdrawal phase) 6-10% great tax sheltered annual returns. Plus these numbers have significant upside optionality in golden periods like multifamily has just experienced. Doesn’t real estate greatly reduce sequence of returns risk? Doesn’t it make FIRE planning easier altogether, especially in times like these when Bogle & Co are calling for lower expected returns in US equities? While I love the Buffett endorsed Bogle plan as promoted by Collins and the FIRE blogosphere at large, I feel they often oversimplify it and conflate average annualized returns over 40 years with FIRE’s 10-year retirement timeline. In the FIRE realm equities are authoritatively and definitively pitched “as by far the best investment class” out there. The sole ambassador to the best FIRE results. As you know, even breaching these topics is akin to sacrilege and blasphemy. “Market timers!” “Real estate is even more risky – don’t you remember the housing crash!” In my view, rental exposure with responsible staggered maturity LTV exposure in the right areas of the right metros is a solid FIRE exposure to have (I’m 60% allocated in this way). My volatility comes from rental rates, rental growth rates, and vacancy rates which are collectively far less volatile than equities over long periods. AND in my case, I do not care about the value of my properties. I have long term staggered debt on them and hope to never sell them. Another alternate tool/asset class that I think is an awesome one for these “low expected return periods for equities” is low LTV hard money lending where you can pretty safely get reliable 6-8% monthly returns (albeit fully taxable at ordinary income rates). Any thoughts, edits, corrections to the above rambling would be appreciated. A blog post comparing the stock and real estate asset classes (including in this current environment) would be amazing! P.S. I recognize that a huge barrier in this equation lies in the difficulties, expertise, and time required to wisely allocate to real estate. There’s no Vanguard auto-pay feature for dollar cost averaging into real estate unfortunately. Thanks for your consideration.

Thanks for the comment! I couldn’t agree more! Real Estate solves so many problems for the early retiree (or any retiree for that matter). The relatively steady cash flow and no need to dig into principal if the stock market heads south are worth a lot.

Do you manage your own properties? All in the same city? My wife and I invested in 3 Private Equity Real Estate investments (multi family, diversification across cities/states), $100k each. One provider is doing another installment soon and we might invest another $100-$200k. Doesn’t work so much as a wealth building tool because you need “accredited investor” status, though. So, one already has to have money to go the PE route. I haven’t dipped my toes yet into managing my own properties. But once retired I will definitely do that too. Hard money loans sound interesting, too, but they are likely tax-inefficient for us.

Blog post on REvs. Equity? Hmmm, sounds interesting. Will put that on the to-do list.

Thanks for stopping by!

Big Ern, thanks for the reply. I greatly value your perspective and I’m comforted by your assessment. I have also taken the institutional route. A typical deal might be a 250 unit class-B complex with value-add opportunity with public transit and decent amenities nearby and within 20 minutes of an urban core. Say it’s a $30mm purchase with $10mm in equity whereby a PE firm, endowment or some family offices take $7mm of the equity, the sponsor/GP 10% and I’m in the 20% friends and family pool. So I’m in good company and the sponsor has skin in the game. I also invest in $100k increments and have dollar cost averaged into quite a few since 2011 in Denver, Phoenix, San Diego, Portland, Houston (unfortunately), San Antonio and Tacoma. I sort of stumbled into the game by happenstance and am so glad I did (I was a stock fund manager pre-FIRE). Good deals are fewer as we’re later in the cycle right now, but I’ve decided to just continue to dollar cost average little by little. Having found this avenue and seeing the sophistication that goes into it, I have no interest in managing my own properties myself. Same here re hard money, but it seems like a sensible tool for the FIRE community to have in the tool kit for shorter term money. But it sometimes seems difficult to even bring up other asset classes in FIREland. Hence my added pleasure in this exchange! I hope you do decide to post on RE vs. equities. I bug Jonathan and Brad about giving it more coverage from time to time. As you say it solves so many problems for early retirees and we are a community of early retirees and those aspiring to do so. I’ve put a lot of thought into it and would be happy to share my experience with you and would love to hear about yours too if you’re ever interested. It’s fun stuff (so far!!! lol). Be well sir. And thank you kindly for some of the highest caliber content in the space!

Thanks for sharing! My investments are in larger funds (~$100 million equity) but they cover multiple buildings each. So, there is already quite a bit of diversification in each fund. I will certainly continue with this and shift our home equity of the condo into PE-RE once we sell and move to a cheaper area.

I’ll second the sentiment in adding managed real estate to help smooth cash flow in FIRE. I’ve contributed a ~70% savings rate to a 75% equity / 20% bond / 5% REIT mix for several years now and had an “accidental” single-family rental in the past (which has now sold). I’d like to add more stable cash flow at this point and Private Equity Real Estate investments seems like a potential means to reach this goal (understanding the accredited investor requirement). Where would you recommend further reading on this subject and maybe a blog post on making this investment? Thank you for all that you do and such insightful articles!

Are you an accredited investor?

(http://www.investopedia.com/terms/a/accreditedinvestor.asp)

You can always invest in your own real estate empire but if you want to be an investor in a Private Equity deal, it normally requires a certain minimum financial net worth and/or income.

One way to start would be to use one of the popular platforms to invest, for example:

equitymultiple.com

I invested in a few PE deals because I happened to know folks in that industry. PE providers cannot actively market their funds because of the accredited-investor-only constraint. If you like to find out more about the company I used, shoot me an email, see the contact form: https://earlyretirementnow.com/contact/

I probably shouldn’t speak for the entire dividend growth investing blogosphere, but for me, individual stock picking, with a dividend growth emphasis (somewhere in between themes 1 and 2 I guess), is most definitely not futile.

The reason being that it’s NOT about trying to beat the market. It’s about reducing the very sequence of returns risk you can’t stop wringing your hands about.

If we define financial independence as a function of passive income exceeding expenses (rather than net worth as some multiple of expenses)…and that passive income stream can be reasonably expected to grow at a rate that exceeds inflation, then there is no drawdown strategy. It doesn’t really matter what the random number generator is doing. How much of my nest egg is the CAPE ratio telling me I can safely sell off this year to pay my bills? How many shares of VOO does it take to cover our groceries THIS month?

Doesn’t matter.

I only know of two passive income sources that can reasonably be expected to grow like that: 1) Dividends and 2) Real Estate.

Granted there is no shortage of “dividend indexes” out there, so one could “passively dividend invest” which I think is what you were trying to describe in theme #2? Not really sure actually…I follow Tawcan too. He picks individual stocks.

But any ETF based on those indexes is constantly re-balancing it’s holdings, and will not provide a predictable income amount. Plus when the market takes a crap, a lot of those companies are likely to cut their dividend because those indexes (at least the ones I know about) don’t discriminate based on the safety of the distribution.

Some people might argue that real estate isn’t really passive, but we recently moved out of California and elected to rent out our property there rather than sell. I can tell you that for 8% of the rent a good property management company makes it about as passive as it can get. I don’t even know the tenant’s name.

So how do you build a portfolio that provides a predictable and growing income stream? You have to pick individual stocks and rental properties. And when I’m doing that picking, my “active” management is primarily focused on the safety of the income and the reliability of its future growth.

Granted I also pay attention to valuation and am always doing my best to try and pick assets that I think are undervalued…but I have no illusions that I’m going to outpace the broader market returns. My focus is on the future income stream…because that’s a way less stressful form of financial independence (in my very humble opinion).

The passive indexing community always defaults to the efficient market hypothesis when discounting dividend growth investing and it’s frankly really annoying. That argument is based on a very narrow (and wrong) assumption that the choice is strictly about chasing alpha.

Don’t want to learn about how to read financial statements? Don’t want to spend the time researching stocks? Don’t want to listen to earnings calls? I get it. It’s not for everyone. The appeal of a “passive” investment approach is strong…but there’s no free lunch.

As this article (and many others you’ve written) very articulately points out, there’s still an awful lot about finance the “passive” investor probably needs to learn. A 100% lazy, set-it-and-forget-it strategy will likely require a huge safety cushion of excess total savings.

Or you can go to school on safe withdrawal rates, and CAPE ratios and all the rest of it to optimize your sequence of return risk/reward profile, etc. etc. etc.

For my money, I’d rather spend my time reading earnings statements.That’s a personal choice between what I’m more interested in learning about.

But don’t call it futile.

Hi CFW! Thanks for stopping by! I suspected folks in the dividend investing world wouldn’t like this. I think we definitely have common ground, though:

Outperformance isn’t everything. I am willing to forego a bit of expected return in exchange for less severe and/or shorter drawdowns. That helps with sequence of return risk. My concern would be that a lot of the attractive styles have also attracted a lot of assets and created crowded trades. See Rob Arnott’s research:

https://www.researchaffiliates.com/en_us/publications/articles/540_to_win_with_smart_beta_ask_if_the_price_is_right.html

Remember, retirees are not the only investors who want to chase equity styles that lose less in a recession. Pensions Funds, Hedge Funds, every single investor would like to achieve that. And prices for dividend payers seem high by historical standards, precisely because so much money is trying to get into that space.

But again: best of luck. And thanks for stopping by!

ERN

For the record, it’s worth noting that I did like this article, and I agree that we do have a lot of common ground. We’re both hyper aware of sequence of return risk, our approach and perspective on what to do about it is just different.

I will reiterate that I don’t use dividend growth investing because of “less severe and/or shorter drawdowns”, but because a dividend payment is not a function of Mr. Market’s whims, but rather a function of management’s willingness/commitment to return capital to shareholders and sufficient cash flow to do so.

The share price is technically irrelevant.

Now with that said, of course course share price still matters when making an investment. The same way you probably wouldn’t be indexing in US equities if the CAPE Shiller ratio was 100, I’m not going to buy WMT with less than a 2% yield. Valuation is a fundamental variable that can’t be completely ignored passive or active.

I appreciate the link, but that too appears to just be more discussion about ever elusive alpha. Pretty much everything is crowded these days. That’s kinda the whole point right? Time to get active whatever your preferred flavor.

Don’t get me wrong: I am a valuation guy. I prefer not to invest in stocks when the CAPE goes too far above 30. But I personally don’t see too much of a difference between two stocks, each with a PE of 20, and the one pays 2% dividend and the other pays zero % dividend. In fact, if the latter uses the 2% extra cash flow and does share buy backs then I should be indifferent. Where Modigliani-Miller Theorem fail?

There might be a small, almost behavioral, reason to prefer the stocks with dividend yield: Management is confident about the stability of earnings. But I don’t see why that’s not already priced into the stock.

You’re right. There isn’t a difference between those two stocks in terms of total returns. The difference is in the mechanism of how you live off those returns.

I can’t buy groceries with stock shares. They have to be converted into dollars first.

If the share price tanks and the PE compresses to 15 or whatever, now I have to sell off a bigger chunk of my investment in the 0% yielding company to cover my expenses. I’m checking my withdrawal rate calculator or whatever to see if I have to cut my grocery budget. That’s what we mean by sequence of returns risk right?

Assuming that the 2% yielding company was selected because it had a conservative balance sheet, and ample cushion to cover and grow the dividend, the company will likely at least maintain the distribution amount, so even though the PE compressed and the share price went down, the yield should go up. I don’t have to give up my organic produce because my income didn’t change.

If I’m living off passive income from dividends, I don’t really care about the share price because I don’t need to sell shares to pay for things. I pay for things with cash that comes in the form of the dividend which is more predictable. Sequence of returns risk reduced. Right?

Now it’s not a guarantee the company maintains the dividend. The share price went down for a reason, and that reason may be the company is struggling and shouldn’t be returning that much capital to shareholders.

Sequence of returns risk can still bite the income investor…I just feel like it’s way easier to identify companies with sustainable dividends that will hold up through tough times than it is to predict and subsequently cope with market volatility.

I think dividend investors tend to forget one simple principle of accounting: One dollar worth of dividends is worth the exact same as one dollar worth of equity holdings. OK, if there are transactions costs and you have to pay a commission and/or bid-ask spread then there is a tiny difference, but let’s assume the equity principal is invested in a Fidelity or Vanguard mutual fund with zero transaction costs. Then $1.00=$1.00.

Let’s take the following example. Investor A invests $100 in an equity index fund, 2% dividend yield. Investor B invests $100 in a dividend stock with 4% dividend yield. Assume the index drops by 20%, and for simplicity, the dividend payment is maintained. Investor A has to sell $2.00 worth of principal to supplement his $2.00 dividend income to maintain a 4% SWR. Now he has $78.00 worth of the fund.

Assume that the stock in investor B’s portfolio also didn’t receive a dividend cut so he gets $4.00.

Who’s better off? That depends on how far the dividend stock falls. If it falls to $78.00 then both investors have exactly the same. That’s what I mean by $2.00 of selling the mutual fund is worth exactly the same as the excess $2.00 income from the dividend stock. If the dividend stock falls by less than 22%, then investor B is better off.

So, in the end, only the total return matters. Sequence of return risk? Only the total return matters. Nothing else. Two stocks have the same total return, it doesn’t matter for the investor which one had the higher dividend yield along the way. Hence, my fixation on total returns.

So, someone has to convince me that dividend stocks have better total returns. Or at least better total returns during drawdowns. Could it be that higher dividend yield is correlated with better quality and lower risk? Sure, but now we are wading dangerously close into the category 1: stock picking. Which is futile because there are lots of professional investors with much better models, much better data coverage, much more up to date data coverage, etc. So, by the time you or I read a balance sheet or earnings statements or footnotes in annual reports, I’d be afraid that the information has already been priced in.

Fair enough. There are plenty of folks who will argue that dividend stocks do have better total returns, but I’m not one of them.

I like them because dividends are cash money and they don’t have the same volatility as share prices. For individual companies anyway. I can’t figure out for the life of me what the distribution is going to be on mutual funds.

I won’t argue with you that investors A and B are in the same boat in terms of total returns. But if investor B is covering all of her expenses with cash from dividends rather than having to sell off bits of her equity stakes, then she doesn’t care who’s better off, and it doesn’t matter how much the share price falls.

I’m surprised that you find no value from the reduced sequence of returns risk. How is it different from real estate? From your comments above:

“Thanks for the comment! I couldn’t agree more! Real Estate solves so many problems for the early retiree (or any retiree for that matter). The relatively steady cash flow and no need to dig into principal if the stock market heads south are worth a lot”

Let’s say investor A makes a real estate investment of $100,000. It is cash flow positive to the tune $1,000/month and after a year the property appreciates 10% to $110,000. Total returns of $22,000 or 22%.

Investor B makes a real estate investment of $100,000. It doesn’t provide any rental income, but appreciates 22% in the year and is now worth $122,000.

Same total returns, so in that sense neither investor is “better off” than the other.

Except investment A is much more useful as a retirement asset because it’s paying a steady, reliable stream of income (that will likely outpace inflation as rents increase), while investment B has to be liquidated in order to convert its value into spendable currency.

I don’t focus as much on total returns, because I can’t spend all forms of returns. I can only spend cash. So investments that return a portion of my total returns in the form of cash are more valuable to me as retirement assets.

Maybe that’s crazy, but I think I’ll sleep a lot easier. The best “draw down strategy” for me is to simply not draw anything down. And I believe picking individual dividend growth stocks is a key part of achieving that.

That’s a good one! I have to give it to you, you are persistent! And by the way, for the other readers around here, CFW and I have a lot in common, including options trading:

https://catfishwizard.com/2017/08/04/dividends-and-derivatives-the-options-trading-strategy-of-a-conservative-dgi/

so I am glad I have this lively discussion with a like-minded investor! Geez, this almost its own blog post in the making here!

I also like income and that’s why I invest in real estate. If I could easily liquidate a small percentage of a real estate investment along the way, then indeed I would not mind holding a property that makes 20+% in a year with no flows in between. But that’s not how the real estate market works. I can’t sell $1,000 a month of that property to match the cash flows of investor A.

Stocks are traded on liquid and efficient exchanges. They can be shorted, they can be bought on margin, etc., so I would be worried that any advantage of dividend stocks could be arbitraged away. Think of the Rob Arnott article that showed dividend stocks are pricier now than the historical average (and with pricier he means pricier over and on top of today’s already pricey equity valuations).

Besides, multifamily housing, if managed properly and conservatively, is actually a pretty good hedge against a recession. The firms that I work with never had any trouble during 2008/9 because people who lost their houses in the recession needed to move somewhere: into multifamily housing.

Same page here. I’m tilting somewhat international based on p e and other valuation metrics. But otherwise I’m passive. I have a glide path in effect as I approach retirement dates going from twenty percent bond to around thrity and then back.

Awesome! Thanks for sharing! Yes, with US equity valuations a bit lofty, looking around for cheaper equity exposure is certainly worthwhile active investing!

Yup, that glidepath over the life cycle is making more and more sense to me now!

Big Ern, it’s almost eerie how similar our thinking is. I, too, have pulled back a bit from equities, and have been growing my “alternative” allocation (Peer-to-peer lending, precious metals, REIT’s, option trading). Great job explaining that “passive” “active” operates on a sliding scale, and it’s always good to consider areas where being more “active” makes sense, even if you’re a passive investor (like me). I always enjoy your posts, great work.

Indeed, our philosophies are very similar. Especially the options trading part fits very well into the current environment: Sell the upside of equities when we believe equities have limited upside potential!

Nice article, like always!

The equity glidepath during accumulation and withdrawal phases seems like a sweet topic for your posts! Looking forward to it!

I wholeheartedly agree that, at least in the US, seeing where valuations are, one should expect pretty low returns over the next 10 years. However, beware linear extrapolation over to the next 40 years. Non-linearities are sure to occur.

I also agree that despite the CAPE at 30 and so many bearish indicators, it still doesn’t feel so “bubbly” and certainly no “irrational exhuberance”. Certainly not here in Europe. I also have a gut feeling that with 0 rates and the changing accounting standards, CAPE has yet to go even higher to be in true bubble territory. It would be an interesting exercise to work out what the “current CAPE equivalent” (using zero rates, etc.) of the long-term CAPE at 30 would be.

Thanks! I agree wholeheartedly. A CAPE of 30 today may be less scary than a CAPE of 30 in 1929. Stock values are a bit expensive, but no need to run for the hills either!

Cheers!

Okay it won’t let me reply to that last comment from you, which probably means the thread was way too long, and I apologize for hijacking your comment section. I also enjoy the lively discussion but the WordPress comment gods are clearly telling me it’s time to save it for another day.

And we do have a lot in common, even beyond options trading (full disclosure: I own index funds and real estate too). Thanks for the kind words and the link back to the mother ship.

I guess our philosophy towards stocks is just always going to be different, which is fine. Even if I could break up a non-income-producing real estate investment into little, liquid, stock-like parcels and sell them off I would rather not. Same as stocks. I don’t like the idea of living off the proceeds of asset sales, because the assets stop growing for me the day I sell them, and I don’t like having to rely on Mr. Market’s determination of what they’re worth that day.

And if dividend stocks are extra-over-priced (like beyond the wider market’s already stretched valuations) that tells me that someone else also values the predictability of a cash payment, and there is “value” in that reduced income volatility.

They can’t all be overpriced, so I’m going to do my best to pick the ones that aren’t. And maybe that is futile as this post would suggest, but at least I have a pretty good idea of what I’m getting in terms of future income. It wouldn’t be the first futile thing I’ve pursued, and probably won’t be the last.

This blog is great. Keep the excellent content coming!

ERN – many thanks for an insightful post. But unless I missed it you did not look at actively managed investing by asset class. There is no doubt that some asset classes are more efficient than others – US Large Cap being the most efficient. We can argue over whether more niche asset classes like emerging market small cap for example have enough inefficiency to allow “skilled” managers to outperform, but there is one asset class that is structurally inefficient. And that is bonds.

A passive investment grade bond fund has to buy bonds that get upgraded and sell bonds that get downgraded simply based on the credit rating. (And don’t tell me credit rating is an efficient measure – how did that work out in the GFC?) Bonds are also a much more fragmented asset class than equities. Most companies have one equity class, but may have multiple issues of bonds with different tenors, coupons, credit ratings etc. So there is a richness there that is lacking in equities. I’m certainly not a apologist for active investing, but there is plenty of data and circumstantial reasoning to support active investing in bonds. I shall have to write a blog post on this…

Cheers AOF

I personally don’t believe that active management is worth it. The more liquid the market, the more easily the “alpha” is arbitraged away.

I give you that one: fixed income markets offer some opportunities, e.g., arbitraging different issues and bonds vs. convertibles, etc.

There is also a niche where people sweep up the issues that have just slipped a notch below investment grade (others have to sell at any cost, so there could be inefficiencies). So, if you like to do something a little bit more active in fixed income, why not. Go ahead, but watch the fees!!!

Big ERN, I think the magic question is: What -would- it take for an actively managed fund to be worth it to you? Or are all they all disqualified? It seems most people who categorically don’t like active funds do it based on premise, not actual results.

People who -do- use them usually have their requirement/screens. For me, it’s:

-Acceptable/low volatility

-Low investment turnover (<40%)

-Tenured management (10+ years)

-Management sticks to their methods through thick and thin regardless of what's hot or not

-The manager has their own money in the fund (can be hard to determine)

– A good 10+yr track record

If a fund has these characteristics, I'm generally interested. Of the 8000+/- funds there aren't many that do, but they exist! And I'm always baffled that Bogleheads will fight for a .02% lower expense ratio but will run away screaming from a fund that's beaten the index by 1%/yr for decades.

Thanks for another thought provoking post, and keep up the cause!

ps – I have no interest in "arguing" about this, but discussing it. I've said the above in other forums and it was if I came in punching babies or something. Which I guess maybe the indexes are their babies…

pps – I know you must have your many resources. Here's one that I've found most useful for investment hypotheticals: https://www.portfoliovisualizer.com/backtest-portfolio#analysisResults

Never say never. If someone could offer me protection against a sizable portion of the downside then I would find that attractive, even if I lose a bit on the upside. That would be more of a macro allocation fund and not so much a stock picking fund. What fund or funds were you thinking of?

Thanks for the link. I like that site very much for quick simulations!

CHeers,

ERN

There are about a dozen active funds (from 3 different fund companies) in my personal portfolio, but I’ll share my favorite three. All of these are with American Funds, so there are caveats: They’re a value fund company so when the markets look great, they tend to lose favor. When the crap hits the fan, more often than not they shine. See the tech bubble for when they worked awesome (and the last crash when they only did “ok”). Also, they can be bought with a load (advice) or more recently without at some self-service firms. The funds are:

Capital Income Builder (CAIBX): If I had to pick one fund “forever”, this is it. Some bonds, mostly stock, some international. If you’re looking for downside protection, this has been a stellar performer. It lost zero money during the tech crash.

Investment Company of America (AIVSX): If a fund can handily beat the index for 83 years, I’m very very interested. Great downside protection overall, with less volatility than the market.

Growth Fund of America: If you’re looking for lots of potential, this kills it. It’s a monster, and since inception (40+ years) has beat the market by around 2% a year. Not every year or even decade, of course.

All these funds, since inception, have killed the indexes and their benchmarks. The last decade they’ve only done so so, and I’m OK with that because of the value focus (which has been out of favor). I’m never going to think I can time the market, but looking at the last decade I’ll be VERY interested in seeing how these funds do over the next decade. Check them out and let me know what you think! And more importantly, if there’s anything you -don’t- like about them. I always want to hear different viewpoints…

Wow, good for you. And thanks for going on the record and sharing this. I couldn’t believe it but AIVSX actually has an inception date of 1934. Not a typo.

WHat I don’t like about the funds:

1: Turnover. Any alpha in the fund would go out the window if you used them in a taxable portfolio. For tax-deferred accounts, they would be OK, though.

2: The outperformance is episodic. AGTHX had an amazing run in the 1990s. Kind of flat relative to a passive portfolio with the same style tilt during other times. Not sure if they can replicate this going forward. CAIBX had a good run from 2000 to 2007, but underperformed the passive style tilt portfolio after that. AIVSX was a bit more steady but again most of the excess returns came from the late 1990s to 2007.

If you had invested in these 3 funds equal-weighted in 1990 you would have had a nice smooth ride. But who knew that back then? How many American Funds were available back then and how many of them had horrible performance and have since shut down? Survivor bias is a serious problem when looking at historical performance of actively managed funds!

*”How many American Funds were available back then and how many of them had horrible performance and have since shut down?” – it’s true for most fund families, including reputable ones. There was a “once hot” Franklin Templeton fund I was looking for the other day and found it had tanked horribly and was closed awhile ago. American doesn’t really close funds. The last one was at least 40+ years ago, and it was merged into another one.

*Turnover: It’s much lower than the average active fund (30% vs 100%), but much higher than an index at say 5%. While about as low as you can expect in an actively managed fund, I appreciate your point.

*Episodic Outperformance: Who knows what the future will hold. But if they keep running the funds the next 30 years as they did the last 30…or 83…years, I’m very interested. You’re one of the few people that might actually appreciate the power of the rolling average – they’ve beat the index for way more rolling 10yr periods than they’ve lost going back through the 70’s, but decades like this past one are sure to happen again. Here’s a little more info on the rolling periods: https://www.americanfunds.com/advisor/pdf/shareholder/mfgessx-005_gfass.pdf

And thanks again for engaging in real conversation on this. We all (including me) learn something when we actually listen, think, -then- talk!

Oh wow, thanks for sharing that! Definitely something to consider. Best of luck with those non-index funds!

I can’t resist jumping in (unbidden). Closing, merging and re-naming funds are all tricks the investment management business use to hide poor performance and obfuscate the investor. It’s incredibly prevalent. I couldn’t lay my hands on any statistics with a quick google, but I’ve experienced it.

Yes, there are some shenanigans going on in the industry. I’ve seen it, too! Thanks for sharing!

My SWR is 7% and I won’t reduce it…4% is a rule of thumb indeed. !

Good luck with that. What’s your asset allocation and your expected returns?

I was shocked recently when I heard Dave Ramsey recommended (and then vehemently defended) an 8% SWR. He also -expected- 12% returns from his mutual funds, so with that reasoning he left room for his 4% inflation bump! Nothing could go wrong there…

Oh, my, don’t get me started on D.R.! He’s a motivational speaker. A good one. I wouldn’t follow his investment advice. 🙂

Cheers!

Hi ERN, what a great blog! I found it through a link to your SWR series and have been devouring all this great info. I consider this a service to the FIRE community – thank you!!

I recently read about the advantages of equity glidepaths right before and after retiring. I am still at least 7-10 years out from retirement and would like to squeeze out as much return as I can in the meantime. I recently shifted from 26% bonds/T-bills down to 20% in my 401k.

I almost put all 100% in stocks, but lost my nerve. The reason being, just the issues you wrote about here, that the recovery is 8+ years old, Shiller CAPE is 30+, etc. If I had it 100% in from the beginning, I wouldn’t change it now, but do you have any advice for how to handle it this late in the game? I’m worried that I will put in the other 20%, and then, just my luck, the market will tank. It would recover before I retire, but I would miss out on all the recovery gains in the meantime. I’m especially worried because the yield curve is getting so close to inverting, and Meb Faber momentum is down. I am not risk-averse at all right now, just want to get a good deal.

I know there are no guarantees, but what would you do in my shoes? Would you leave that 20% in bonds and wait patiently for a big drop in stock prices? Move it to stocks immediately? Shift to stocks gradually? Keep an eye on CAPE and act accordingly?

Cheers, enjoy your retirement! 🙂

Hard to time this. I’d not worry until 3-4 years before retirement. 80/20 seems like a good compromise that would work during the last few years of working. Maybe shift to a little bit more bonds gradually when 3 years away from retirement. Then back into stocks while in retirement.

Cool, thanks! 🙂

Funny thing is, I had 90-95% in stocks until 2015, when I put it all into a Lifecycle fund that gets more conservative over time (this is the mistake I’m trying to correct now). It’s a typical Lifecycle fund in that it shifts more to bonds and then remains there for the long-term — not a good strategy for early retirement! Maybe not even a good strategy for regular retirement! I wonder when the folks who design these Lifecycle funds will read the research and correct this problem… Amazing how much people do based on intuition rather than actual numbers!

Lifecycle funds are not a good option for us in the FIRE crowd and – as you suspected – not even for traditional retireees: The shift out of stocks starts too early: already 20+ years before retirement. And then further falls during retirement.

I think it may be a legal constaint and CYA issue for the providers that they don’t want to raise the equity portion in retirement.

I think you’ll find it’s less CYA and more KYC – Know Your Customer. They know that most retirees won’t tolerate the value swings that you and I might. Out of the several hundred retirees I’ve talked with not one of them was comfortable with a medium sized dip anywhere near retirement. Not one!

It’s easy for us to just say “Learn the history of the market and stay the course – you’ll be fine” because we’re already comfortable with the swings. Most people, unfortunately, are not. Hence, from an “allocation and behavior” standpoint, they work.

Very good point! Makes sense.