Welcome to the sixth installment of our “Ask Big Ern” series where I perform case studies in safe withdrawal calculations. See here for the other parts of the series.

Let’s make this Geographic Arbitrage Week because after Monday’s guest post on “Geographic Arbitrage,” I will now feature a case study with the same theme! Meet Mr. Corporate (not his real name) who reached out a while ago for advice on whether he’s ready to leave the corporate life. Just looking at his numbers I knew immediately that there is no way he and his wife can retire in their current location. But Mr. C found that moving to another country with lower living expenses will cut years off the time it takes to reach FIRE. And we’re talking about a country in Europe (he wouldn’t mention which one), with a high quality of life, nice climate, and a good healthcare system! Can he retire now? Let’s look at Mr. C.’s numbers…

Mr. Corporate’s situation

I’m 39 years old and my wife will turn 40 next month. I make about $250K plus another ~$50-75K in RSU’s granted each year that vest over a 4 year period. My wife does volunteer work full time and does not collect a paycheck, but frankly, I feel like she works more than I do – and is a lot more satisfied! No kids. We are looking to retire early (probably April 2018). I’m not sure if it’s a full retirement for me, or if I’ll do some projects on the side, but I definitely want to get out of the corporate world. We currently live in high cost of living and are looking to sell our house and move to Europe to a low cost of living area.

Assets:

- 401K: $350K (invested in S&P 500 Index Funds).

- Vanguard: $117K (90% VFIAX and 10% VBTLX, although I’m thinking of moving all to VFIAX). (95% of this is cost basis, only 5% capital gains).

- RSU’s [Restricted Stock Units]: I currently have $108K vested with another $30K set to vest before I quit. [ERN confirmed: Net of taxes!]

- House: I expect it to sell it in 2018 and get $600k net after paying off the mortgage.

- Savings: $50K in a credit union savings account

Wow, that’s a nice nest egg! It’s probably not enough to retire in your current HCOL area but this goes a long way in a more affordable country!

Social Security: If we never work again, our payments at 67 are estimated to be $2,198 (me) and $688 (wife)

Nice! And keep in mind that your wife, at least under the current rules, has the option of receiving 1/2 of your benefits, which would be higher than her own. Of course, given your age, I’d still like to apply a 20% haircut to your benefits in light of potential benefit cuts in the future. But $31,651 in benefits (=$2,198×1.5x12x0.8) in today’s dollars (!) is still a very impressive sum.

Retirement Life and Expenses: When we move to Europe I expect our yearly living expenses to be ~$35K / year. $25K for regular living expenses, $7-8K for travel, and some wiggle room. We have a pretty solidified plan for spending our time doing volunteer work in Europe which we are really excited about, learning the language, and immersing ourselves in the local culture. We have the means to become permanent residents there so the plan is to stay there if we can. Since we don’t have any children, we don’t really need to leave any money to anyone, so that’s not a concern. We will move our US home base to a state where we will have better tax treatment for things like capital gains, etc.

This is the beauty of geographic arbitrage! For $35k per year, you can probably rent a 1 bedroom apartment in some of the notorious HCOL areas in the U.S.! But $35k a year affords you a pretty nice lifestyle, including housing and healthcare.

Questions

- Will we have enough for retirement or will I have to supplement with some part-time/project work?

- How should I draw down my funds?

- Should I think about doing a Roth IRA conversion ladder?

- I’ve read every single one of your blogs and love them. One question I had was how to easily calculate CAPE and then adjust monthly or yearly withdrawals based on that? I may have missed it.

All excellent questions. We’ll get to those later. First, let me make clear that there are a few aspects of the move to Europe that I can’t confidently comment on:

- Immigration: I’m not an immigration lawyer. I assume you and your wife have dotted all the i’s and crossed all the t’s on that front.

- Taxation: I’m not a tax expert, certainly not on taxes abroad. For the calculations here, I assume that you stay a U.S. tax resident and don’t have to pay taxes in your new domicile. I hear that many European countries have much higher taxes on capital gains and dividends than the U.S.! Before you move you probably want to talk with a tax attorney (potentially one in the U.S. and one in your new home country) to confirm.

- Health insurance: In our email exchanges, we confirmed that you will pay for health insurance out of pocket in your new country (already included in the $35k budget). I would make sure that you can also avoid the mandatory Obamacare premiums in the U.S. Of course since you’ll be able to keep your taxable income quite low (more on that below), O-care wouldn’t cost you much so maybe it’s not a bad option to have in case you plan extended visits back in the U.S.

The gorilla in the room: Exchange Rate Risk

Before we get started with the SWR calculations, let’s point out one of the drawbacks of international geographic arbitrage: You have a portfolio denominated in dollars but expenses denominated in Euros. What can possibly go wrong? The Euro could appreciate vis-a-vis the USD! Then you’d have to cut your expenditures and/or increase your withdrawals from your USD denominated portfolio. Currency fluctuations can be brutal! And they are notoriously hard (impossible?) to predict. The spot exchange rate is about $1.18 per Euro at the time of writing this. But since 1999, the exchange rate ranged from $0.82 to over $1.60. If the EURUSD exchange rate were to go back to its peak from around 10 years ago you’d have to increase your withdrawals by about 36% to around $47,500 per year, just to maintain your spending level.

How do you alleviate exchange rate risk? I can think of at least a few possible routes:

- A currency hedge through derivatives. Sounds complicated, but it’s actually pretty simple. You’d need a brokerage account that can trade currency futures. I’m not sure you want to go that route because it raises a few issues. For example, do you want to hedge the entire portfolio or of only a portion? The profits from hedging could eat up your 0% federal tax bracket and invalidate your Roth conversion ladder. Or you might just not be comfortable dabbling in derivatives and trading EURUSD futures on margin.

- Buy Euro-denominated equities. Not the entire portfolio but a significant portion. For example, an ETF like the Ishares Ticker IEUR (0.10% annual expense ratio) or Vanguard’s VEUSX (also 0.10% expense ratio), while traded in the U.S. and denominated in USD, the underlying securities are European stocks. Careful, though, because this also includes Swiss and U.K. stocks that are not traded in Euros (there is a Eurozone-only fund, Ticker EZU, but that has an almost prohibitively high expense ratio: 0.48%!). Even with the UK & Swiss stocks, you should get a decent degree of currency hedging and maybe some diversification benefit as well. Though, keep in mind my recent article on the limits of international diversification. Whatever international fund(s) you buy, make sure they are not currency-hedged! For example, the iShares Ticker HEFA (Currency Hedged MSCI EAFE) would be hedged back to USD, which is something you don’t want. You want the foreign exchange rate exposure!

- Ignore the currency risk and if the Euro appreciates simply increase the withdrawals up to a point. Maybe generate some supplemental income. If you see that you deplete your portfolio too fast, simply do a reverse geographic arbitrage and move back to the U.S., to a low-cost area. As we will see below, you do have quite a bit of a cushion and could probably withdraw closer to $48,000 and still be safe.

- Another reason to not stress out too much about FX risk; in the event of another global market meltdown, the USD will likely appreciate (the USD is a safe haven currency), so not hedging the currency exposure could actually provide a hedge against Sequence Risk. But, of course, there is no guarantee that the next crisis looks like the last one.

The safe withdrawal rate calculation

Starting with your $1,255,000 portfolio and taking into account your Social Security benefits, let’s punch that into the Google Sheet and see how different historical retirement starting dates would have performed. I am using an allocation of 80%/17%/3% Stock/Bond/Short-term and the roughly 0.2% monthly income from Social Security (in % of today’s portfolio) starting in year 27 (month 325):

Link to Google Sheet

The results look really good: Even with today’s elevated CAPE ratio and Social Security pretty far in the future, you can probably go up to around 3.9%. That’s almost $49k per year. The $35k per year would be only 2.8% of today’s portfolio, much lower than all the failsafe withdrawal rates. But again, due to exchange rate risk, you probably want this safety cushion.

Cash flows until age 70

I always like to simulate the cash flows and portfolio holdings up to age 70 just to make sure there are no obvious problems with a) running out of money in taxable accounts before age 59.5 and b) over-accumulating money in tax-deferred accounts that would trigger a nasty tax bill at age 70 when required minimum distributions kick in.

You are in an extremely fortunate situation in that you’ll have plenty of assets in your taxable accounts to fund your life until you turn 59.5. And they are almost exclusively cost basis and almost no capital gains!

Assumptions:

- Zero capital gains between now and April 30, 2018. Let’s be conservative on this one.

- In April 2018 you withdraw $15k from your cash/money market holdings and take another $20k from your home sale to fund the first year of retirement. Even though it’s only 2/3 of a year I apply the full $35k in expenses to account for travel, startup costs, etc.

- You’re left with $1,220,000 spread over a money market account ($35k), taxable account ($835k), 401k ($350k). No Roth IRA.

- I assume you keep 100% stocks in the taxable account, 80/20 in the Roth and 40/60 in the 401k. Not a typo, you keep more bonds in the 401k to bring the overall allocation to 80/17/3.

- Expected returns are my conservative projections I normally use in the case studies. Notice that the expected returns are just estimates and per year, so for the 8 calendar months of the year 2018 you’ll make only 2/3 of that return.

- Starting in 2019, you do the Roth conversions up to the upper edge of the 0% federal tax bracket, keep the cash account at 1x annual spending (and adjust the withdrawals accordingly) and withdraw from the taxable account (dividends, principal, and capital gains) to match the after-tax target. I use the Excel Solver function to do that.

- I assume that on the state level you have a $15,000 standard deduction plus exemptions in 2018 (CPI-adjusted after that) and all income (including dividends and capital gains) is taxed at 3% beyond that.

- Notice that you’ll not owe federal taxes as long as you keep ordinary income (interest from cash account plus Roth Conversion) equal to the standard deduction plus exemptions. Dividends and capital gains are low enough to be taxed at 0% in the first two federal brackets.

- I assume you continue with the Roth Conversions until the 401k is depleted.

- I assume you’re both 40 on each January 1, 2018. Close enough!

Results:

- Even with the withdrawals and CPI-adjusting the withdrawals, you actually grow your overall portfolio! Even after inflation! So, there’s plenty of safety margin!

- Success!!! You should be able to move the entire 401k balance (!) over to the Roth by age 62/63 while only paying (very modest!) state taxes. This is the first case study where this works so beautifully! In many other cases I have seen (including my own) retirees are lucky to merely curb the growth in the 401k plan. Many might still get hit with a 25% marginal tax after age 70 when the RMDs kick in! You can avoid all of that.

- You might owe some income taxes once Social Security kicks in. I assumed that 85% of your Social Security benefits are taxed as ordinary income. That’s a conservative assumption. You might actually pay less if you don’t have much other income.

- If returns are nice and smooth as in the calculation you never even get close to running out of money in the taxable account. Though careful, with a deep enough recession you certainly will.

Summary so far: Both the SWR historical simulations and the cash flow analysis over time look really good!

A dynamic Withdrawal Rate System

Back to your question:

I’ve read every single one of your blogs and love them. One question I had was how to easily calculate CAPE and then adjust monthly or yearly withdrawals based on that? I may have missed it.

I think that’s a great question! We sometimes forget that withdrawals are not something you want to set and forget. You should constantly revisit the withdrawal amounts and check if they are still sustainable. A CAPE-based rule I personally liked a lot is to use the one recommended in the post from a few weeks ago (SWR series Part 18):

SWR = 1.75% + 0.5 x 1/CAPE

Maybe if you’re a bit more conservative with your withdrawals, take it down to

SWR = 1.50% + 0.5 x 1/CAPE

With today’s CAPE of around 30, the safe withdrawal rate would be 1.50% + 0.5x(1/CAPE)=3.167%. (Side note: for some of the European indexes the CAPE is a bit lower so your overall portfolio CAPE might be lower which will increase your SWR!) Multiply that 3.167% rate by your net worth ($1,255,000) and your withdrawal amount comes out as $39,742 p.a. or $3,312 per month. Of course, this calculation is still too conservative because a) you’d ignore your Social Security benefits and b) you ignore your willingness to exhaust your capital in the long-term (the CAPE rule was calibrated to preserve capital indefinitely!).

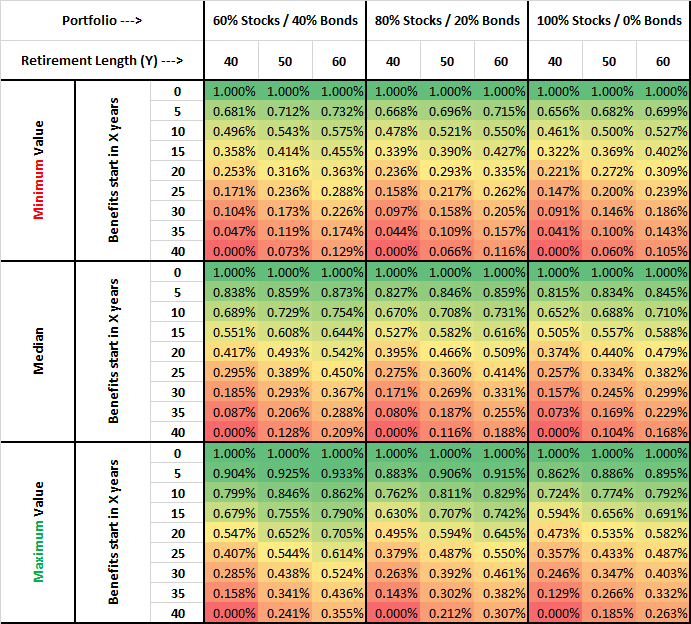

Adjusting for Social Security

This calculation was the topic of Part 17 of the SWR Series. Given that you expect around 2.5% of today’s portfolio in future Social Security benefits (with COLA!), how much of an additional withdrawal amount would that imply? According to the calculations from that post, with an 80/20 portfolio and a horizon of 60 years, you can increase today’s SWR by at between 0.262% (25Y horizon) and 0.205% (30Y horizon) per 1% of future COLA benefits. And that’s the worst case scenario! Taking the weighted average to get the value for 27 years, we get 0.239%. Multiply that by 2.5 because you’re expecting 2.5% in benefits relative to today’s portfolio and we get an additional 0.6% in the SWR. Add that to the baseline CAPE-based SWR and we are now at 3.767% SWR. Cool, we increased the initial withdrawal amount to over $47k!

Adjusting for capital depletion

Analogously to the Boglehead VPW calculations, we can determine the withdrawal rate that would amortize (deplete) your initial portfolio over time. Here’s how to do that in MS-Excel. It’s roughly the same as a mortgage payment calculation:

=PMT(0.03767/12,720,-1,0,1)*12

- The first argument is the rate of return per month (simply divide annual SWR of 3.767% by 12).

- 720 is the horizon in months.

- 1 is because we calculate this one dollar of initial capital. Why you have to add a “minus” I don’t know, it’s one of the MS-Excel quirks.

- 0 is the final target value. Set this to zero for capital depletion. Or 0.5 for targeting exactly half of the initial portfolio (in real terms) as final value target, or any other value between 0 and 1, depending on whether you like to leave a bequest to loved-ones or charities.

- 1 is for setting the payment (withdrawal) at the beginning of each month (as is customary in the SWR studies I do). For the standard mortgage calculation, this would be set to zero (= payment at the end of the month).

Calculating this in Excel, I get an SWR of 0.04194, i.e., 4.194% annualized. That’s even a little bit higher than the SWR calculated with the historical simulations. Makes sense, because your withdrawal amounts will decline in case of Sequence Risk and bad returns early on. But even a drop of 35% in withdrawals would still keep you above the $35,000 target you set.

Adjusting the SWR when going forward

Of course, the CAPE will change every year and the number of years before reaching Social Security will decline. Same with the capital accumulation adjustment. So, you should recalculate this number every once in a while to see if you’re still on track with your withdrawals! I get my CAPE numbers from Robert Shiller (link here and click the link “U.S. Stock Markets 1871-Present and CAPE Ratio“). For international CAPE Ratios (with some moderate delay, though) I use StarCapital.

Conclusion

It looks like your early retirement plan is in very good shape. Your major risks are currency fluctuations and a bear market early on in retirement. Potentially health care costs later in life. But considering you have two cushions, 1) the potential to raise your withdrawals and 2) the possibility to do some part-time work, there is no reason to delay early retirement anymore. Have fun in Europe! Send me a postcard and Best of Luck!

We hope you enjoyed today’s case study. Please share your thoughts and comments below and also make sure you check out the other parts!

- Ask Big Ern: A Safe Withdrawal Rate Case Study for “John Smith”

- Ask Big Ern: A Safe Withdrawal Rate Case Study for “Captain Ron”

- Ask Big Ern: A Safe Withdrawal Rate Case Study for “Rene”

- Ask Big Ern: A Safe Withdrawal Rate Case Study for “Mrs. Greece”

- Ask Big Ern: A Safe Withdrawal Rate Case Study for Mrs. “Wish I Could Surf”

As far as what state to relocate to prior to moving to Europe, Mr Corporate should check out South Dakota. You spend 1 night in a hotel there then bring the receipt to the DMV. You walk out with a South Dakota Driver’s License.

https://www.youtube.com/watch?v=5JyRSViMwOM

mydakotaaddress.com

yourbestaddress.com

americas-mailbox.com

Many RVers do this prior to hitting the road full time to 1.) eliminate state income tax, 2.) reduce car registration costs, and 3.) reduce car insurance costs.

Excellent point! You don’t want to get a fat tax bill from your former state that still claims you as a resident even though you’re an expat. Gotta love the zero % income tax in SD and the lax residency requirements!

Big ERN,

I should be doing w*rk right now. But it is oh so much better to read your incredible posts!!! 😉

Thanks for the compliment! Get your weekly dose of ERN-omics and you’ll make it through the rest of week! Cheers!

Do you have a post (a search didn’t turn it up – but I am worried I blindingly obviously missed it) on using your worksheet to do our own study? My nest egg is less than half of your typical case study, so I doubt my analysis would be of much interest to you or your readers 🙂

The sheet is here:

https://docs.google.com/spreadsheets/d/1QGrMm6XSGWBVLI8I_DOAeJV5whoCnSdmaR8toQB2Jz8/edit?usp=sharing

And the documentation is here:

http://earlyretirementnow.com/2017/01/25/the-ultimate-guide-to-safe-withdrawal-rates-part-7-toolbox

Let me know if you have questions!

ERN

Big ERN

Thank you so much for featuring my story. I thought we had enough, but having a second pair of eyes that could apply an additional layer of rigor and unbias analysis truly helps. I can’t thank you enough.

The thinking around exchange rate was, although not new, something to definitely be on the lookout for to make sure it doesn’t blow up our plans.

I don’t have a Roth account yet, so I will need to get started on that too!

Thanks again!

Great! Glad you liked the case study! Best of luck!

Great post!

One of the things I like is that we are also discussing currency risk. Most blogs and information on the FI community is directed to US-based persons. But if you live in Europe and are fully invested in the US stock market (as I am), you really don’t have a lot of guidance regarding what is an appropriate SWR. Especially taking into account that the EUR is not that old.

Would love to see more about SWR for the European-based FI community.

Thanks again!

Good point! Of course, there isn’t a long enough history of FX rates to simulate the entire 1871-now period but I think I can do a case study on this with the 2001 and 2008/9 crisis. On my to-do list!

But my advice applies to you as well: Now might be a good time to shift into Eurozone stocks both from a valuation and a currency hedging point of view!

Thanks for stopping by!

Great study again. I wonder why the tables end at the age of 70? Sorry, didn’t click on the Google link due to my time constrains, is the estimated end value there?

I personally like options 3 and 4 in regards to hedging because obviously I’m clueless about it. And when I’m clueless, I’m afraid to invest in such stuff. I guess that is part of my risk tolerance/profile (while I’m sitting in the USA)…

Now, how do we get the secret out of Mr. Corporate with regards to the country in the EU they’re considering? I’m nosy of course as we have some thoughts of doing a little bit of European geographical arbitrage ourselves in much farther future though. The article mentions that they ‘have the means’ to establish their residency there which in addition to financial means, it might also imply that one of them has some kind of heritage ties to that country that would help their path to becoming residents there.

Ahh, and I’d also add to Big ERN’s list of research for them. In addition to immigration, taxes, and health care, they should investigate estate questions as well and how that country treats assets kept in the USA or other countries, but not within the country of residence. I asked a bunch of questions on the guest’s from Portugal post https://earlyretirementnow.com/2017/10/16/guest-post-geographic-arbitrage/ but since the guy is local (and probably not married and w/out kids) he knows nothing about estate planning in general and especially for people moving from the USA.

Thank you for your good work, ERN.

Mrs.Greece

Good points:

I stop at age 70 if there is a good reason to believe there is no concern the money will out later. In most cases, there isn’t. 70 is also relevant because I like to see if RMDs create a problem.

I’d add estate issues to the important FIRE components that people should consider. Completely agree! WHether you’re an expat or living in the U.S.!

Thanks for stopping by!

Hi Mrs. Greece

It is possible to buy, or more likely, ‘invest’ your way into Europe I think. For instance, Malta has a residency program where you can obtain residency in exchange for a one-time investment of 880k €. Many wealthy Russians go this route. Using a local bank to invest this amount into something (local?) may be sufficient. An investment in a local property (you have to live somewhere, right) will qualify as well.

Residency in Malta will give you a EU passport.

Nice! I also like that Malta doesn’t tax you foreign income!

Re the “Exchange Rate Risk”. I’m not sure how it’s possible to hedge with derivatives in a reasonable way, without knowing the actual income the companies in the equity portfolio are earning in each currency. I would assume (maybe mistakenly), that most large pharmaceuticals (in the US and EU) for example, have a very similar share of the earnings derived from the US Vs. Europe. In any case, Swiss large companies, derive only a very small fraction of their earnings from Switzerland, so for a person spending Euros, there is probably no difference regarding his “Exchange Rate Risk” if he holds a large cap Euro-denominated company or a large cap Swiss Franc-dominated company.

It’s relatively easy to hedge the FX exposure. You hedge the portfolio value, not the dividend flows. Example: you have a $1.2m portfolio. One EURUSD futures contract is E125,000 = around $147k. If you want to hedge half of your portfolio you buy 4 EURUSD futures contracts.

I guess i wan’t clear. My point is, that many European companies are earning about 50% of their income in the US in USD. So by buying this European company, you are still 50% exposed to FX risk, although it’s an EU company EUR-denominated. The same thing, with US companies deriving let’s say 40% of their income in EUR. If you hold such a company, it makes no sense to hedge the full value of your holdings with EURUSD (40% are already tied to EUR, and another e.g 20% to a variety of other currencies where this company is doing business).

My previous comment was my first one on the blog, and i forgot to write how much i enjoy your blog. Thanks!

There are two other reasons why I don’t like to hedge the currency risk based on European equities:

– Long term (and even short-term) I believe much more on the US economy. Compared to European companies, US companies are much more dynamic, aggressive and adaptable. Also, when the economy crashes in Europe it takes way longer than in the US to recover.

– The trinity study was based on the US historical returns. If we based this on the performance of the European markets, you have no guidance (at least that I know of) regarding what would be a SWR. Even without talking about currency risk.

Agree with the first point. I also think that monetary policy will be more hawkish than people expect in the U.S. (=USD hawkish).

But the good Mr. Corporate has decided to retire in Europe. I can see that transferring over the balance to Europe might not be feasible (especially for retirement accounts), and the SWR studies are mostly US-centric (though Wade Pfau has done some international comparisons). Given that we have currency mismatch between assets and liabilities there is still the question what we should do about it. Given that staying in the US is not an option for now.

Thanks for the compliment!

I’d not rely on European companies getting revenue in USD and folks getting a hedge through that. EU corporations are trying to smooth their profits measured in their own currency and they likely hedge a lot their FX exposure back to Euros. And the same for US companies with EUR revenue. So, I would still try to find some way to equalize the currency exposure between your assets and your liabilities.

Cheers!

I’ve got another question to Big ERN, but I welcome anyone’s great opinions ;-).

Portfolios of all case studies and your own have been tested to prove that they hold (and thrive) in various environments. It feels great on paper, but considering the current environment doesn’t it give at least some concerns in regards to the risk of the subsequent returns in the light of current peaks the stock indexes keep beating?

I didn’t even realize that Dow went from 20,000 to 23,000 so fast. I recall reading daily news snapshots in The Wall Street Journal when the Dow was teasingly close to the 20K mark and it took some time to cross it, but once it did, it feels it just jumped to 22K and then 23K. Wouldn’t this environment qualify to be called something like “on the way to insanity”?

I also read that some “pundits” predict a crash or something by next summer because their reasoning goes this bull market cannot *psychologically* beat the longest historical bull run. I’m sure there’s another camp of ‘pundits’ who wager this bull market will become the longest. I cannot wait to see who’ll be right.

Anyway I’m trying to get to my question LOL. So considering we are floating at the peaks how should the potential early retirees prepare for the potential crash in your opinion? I read that a handful of bloggers (including yourself) intend to pull the plug next year. Your portfolio is very large, but I’m talking of people who have less than $2M-$3M. Should such people have cash for the next 2-5 years? I think I would lean towards bucket management, but I haven’t considered seriously yet.

Mr. Corporate and yourself will be selling your houses. If other ERs do the same, should they invest or keep in cash and wait for that crash?

Of course, it all depends on one’s risk profile, but I’m curious of opinions how to prepare for that ‘out the door of work’ period of 2 to 5 years when the stock market is at the peak or getting close earlier or later.

And sorry for rambling ;-),

You cannot know when, or if, the market will correct. I think everyone feels we’re at a peak, but who knows, maybe reported earnings will keep up. If earnings keep up then there will be less pressure to sell. A scandal could break out or a major bankruptcy could occur, or a a major global war could start but you can’t predict when these will happen.

Exactly! The CAPE is horrible at timing the peak. I was worried about an equity peak when the S&P500 crossed 2000. Now at 2575. The next bear market will come and everybody will be surprised. The best hedge is a lower SWR (ideally based on the CAPE) and a bond->equity glidepath.

Thanks, Mrs. Greece! Great point! As you mentioned, the SWR studies look at a variety of things that can go wrong with your portfolio: 1929, 2000, 2008 and the lesser known 1965/66 to 1982 mess. My research can’t ever give me any certainty but it gives me confidence that we’ll weather the next crisis, whether it’s in 2018 or 2028.

Personally, I’m not a huge fan of the bucket management and cash cushion approach, see the SWR Part 12 because of the drag on performance before the event and the need to replenish the cash cushion and missing part of the the subsequent bull market. Besides, there is no cash cushion large enough to get you through the 1965-1982 episode. There, only a low initial WR (and potentially even lower withdrawals along the way) will help!

Perhaps I missed it (I’m reading this on his cell phone) but I don’t see any accounting for local taxes in the country to which Mr. corporate is moving. even countries that don’t tax new residence initially eventually subject them to taxes after a defined period. And sometimes those taxes can be onerous. If you’re moving to Spain for example you could be subject to inheritance taxes if one of you dies – even though you were legally married. And those inheritance taxes are for bidding Lehigh for Americans, who do not benefit from favorable treatment that European citizens get from the Spanish government

In addition quite a few countries have a wealth tax, including France and Spain. It could depend on what province you live in, but wealth taxes could wipe out most of the gains (after inflation) in your portfolio.

Perhaps I missed it (I’m reading this on a cell phone) but I don’t see any accounting for local taxes in this case study. Even countries that don’t tax new residents initially will eventually subject them to taxes after a defined period (eg 10 years in one case). And sometimes those taxes can be onerous. If you’re moving to Spain, for example, you could be subject to inheritance taxes —WITHIN your marriage—so, if one of you dies – even though you were legally married, The survivor will pay for half the summer. And can’t help you if you inherit your parents house or a state. That, too, is subject to taxation at Spain’s national level (as opposed to provincial level is), and it is exorbitant. Recent court cases and spin have protected European citizens from this discriminatory treatment, but they do not apply to us.

In addition quite a few countries have a wealth tax, including France and Spain. In Spain, the amount depends on what province you live in, but they can be as high as 3.25% of your global assets. That’s enough to wipe out most of the gains (after inflation) in your portfolio.

You made an interesting observation that, by switching to a portfolio with more exposure to European equities, the CAPE ratio of the portfolio would drop, allowing for a higher SWR. Does this imply that what can be considered a ‘normal’ CAPE ratio is the same value across global markets?

In a transcript of one of your podcasts I (think that I) read, you suggested that, given current regulation and things like that, a ‘normal’ CAPE ratio for the US market would be 20, rather than, previously, 15. Your suggestion seems to imply that, overtime, due to changing regulation, what can be considered a ‘normal’ CAPE ratio may change. This probably also means that, due to difference in local regulation between the US and the rest of the world, I cannot simply assume that a ‘normal’ CAPE ratio for the rest of the world is also 20?

For instance, StarCapital, as of May 31st ’18, lists the Developed Europe CAPE ratio at 18.9. A conservative CAPE-based SWR, when 100% invested in Developed EU, would then be 1.5+.5/.189 = 4.15%. This just feels wrong to me, especially because, historically, equity markets in the US have had a offered a better return than, well, anything else, I believe.

I’m thinking that calculating a SWR for a well-diversified worldwide portfolio is much more complicated than using the formula for the conservative CAPE-based SWR I used here… which is only relevant for the US market?

The caveat is that in the rest of the world you have higher payout ratios and thus less room for earnings growth. Not sure I’d apply the exact same “normal” CAPE across all countries.