October 14, 2020 – Welcome to a new installment of the Safe Withdrawal Rate Series! 40 Parts already! If this is the first time you encounter this series, I recommend you check out the landing page here to find your way around.

Today’s post is about a question I’ve encountered quite a few times recently. If Sequence of Return Risk means that you face the danger of retirement ruin from liquidating (equity) shares during a down market early during retirement, why not avoid touching your principal altogether and simply live off the dividends only in retirement? Sounds reasonable, right?

But by solving the “running out of money” problem we create a bunch of new questions, such as:

- Will the principal keep up with inflation over a typical retirement horizon?

- Will your dividend payments keep up with inflation over time?

- How much volatility in the dividend payments would you have to expect?

So, in other words, the “dividend only” strategy – simple as it may seem – is somewhat more complicated than your good old Trinity-style 4% Rule simulations. In the Trinity Study, failure means you run out of money before the end of the retirement horizon – simple as that. With the dividend-only approach, failure can come in many different shapes. For example, you may not run out of money but the volatility of dividends could be too high and/or you face deep and multi-year (or even multi-decade!) long drawdowns in dividend income and/or you have to live like a miser early on because the dividend yield is so low. All those are failures of sorts, too. Then, how good or how bad is this dividend-only approach? Let’s take a look…

Before we get started

First, please check out my appearance on the Morningstar “The Long View” Podcast: Cracking the Code on Retirement Spending Rates!

![]()

Next, I want to stress that I wrote today’s post just out of plain, pure academic curiosity. It’s not meant as a “hit piece” targeting the “dividend crowd” who I sometimes clash with because I’m mostly a passive broad index investor. All my simulations here are for a simple, 100% S&P 500 portfolio, not a dividend-focused portfolio, nor a dividend-growth portfolio or whatever the flavor du jour out there may be right now. If you remember my posts from 2019 about the ill-fated “Yield Shield” approach (Part 29, Part 30, Part 31), I stated very clearly that the failure of the Yield Shield is mostly due to 1) higher risk and less diversification in the fixed income portion and 2) the severe underperformance of international stocks during/after the Global Financial Crisis. Replacing U.S. stocks with U.S. dividend stocks didn’t really hurt the Yield Shield during that time. Though, dividend stocks took a beating in 2020, more on that below.

In any case, let’s go ahead and answer some of the questions above. For dividends, I use the S&P 500 12-month rolling dividend series provided by Prof. Robert Shiller as part of the CAPE worksheet. See the source file here. I look at monthly historical data from 1871 to 2020 and historical retirement cohorts with a 30-year horizon.

Side note: The index in its current configuration has been in use only since 1957. Between 1926 and 1957, I’m using the S&P Composite with fewer names, and before that a historical reconstruction of the index all the way back to the year 1871.

Normally, that would mean that 1990 is the last retirement cohort I can simulate. But guess what? I like to extend the sample all the way to 2010 to include the market peaks prior to the dot-com crash and the Great Recession/Global Financial Crisis. So the last 240 retirement cohorts will have a slightly shorter and shrinking window of anywhere between 10 and 29 years. Still, long enough to display some of the stats I’m interested in, i.e., final portfolio value, the volatility of dividend income, etc. So, please keep that in mind: all cohorts between 1990 and 2010 have this little asterisk behind them!

Here’s the first issue I’d like to address…

Will your portfolio keep up with inflation?

Well, that’s an easy one. We simply have to plot the 30-year price return (i.e., without dividends) of one dollar invested and adjusted for CPI inflation. That’s what I do in the chart below. Most cohorts would have easily preserved their capital and even grown it quite substantially. The minimum and maximum final value are both due to the Bear Market during the Great Depression. 1902 was the low-point because your final value was the Bear Market bottom in 1932 and you’d lost about two-thirds of your purchasing power. But if you had started in 1932 you’d have grown your portfolio to 6x the initial value, even after inflation and even when withdrawing all dividends.

Most notably, though, for all retirement cohorts post-1920, the 30-year real price return was positive, so for every $1 in real starting value you’d have had more than $1 in inflation-adjusted dollars after 30 years. Hence, you would have preserved your capital in the worst case and likely would grown your nest egg to many times the starting value. In a way, that’s great news for the dividend strategy. But it also means that you might vastly over-accumulate assets during retirement. Which in turn means that you likely short-change yourself with your withdrawals. Withdrawing some of the principal early on would have been the better path.

What were the initial dividend yields?

In the chart below I plot the dividend yield in the S&P 500. I use the 12-month rolling, backward-looking dividend income as used by Prof. Robert Shiller divided by the S&P 500 index value. Notice that both dividend income and the S&P 500 month-end value are nominal values but since we’re taking the ratio, there’s no need to perform any CPI-adjustments. In any case, notice how volatile the initial dividend yields would have been. Prior to about 1950, we had huge swings in dividend yields, with an average yield of around 5%. But bouncing around between 3% and over 15%!

In the second half of the sample, dividend yields became a lot less volatile. But at a price; yields were also lower on average: around 3% in the 1960s and early 80s, a short step up to 5-6% again but then a final step down to around 2% for much of the last two decades.

This brings us to the next question…

Should we be worried about the low dividend yield these days?

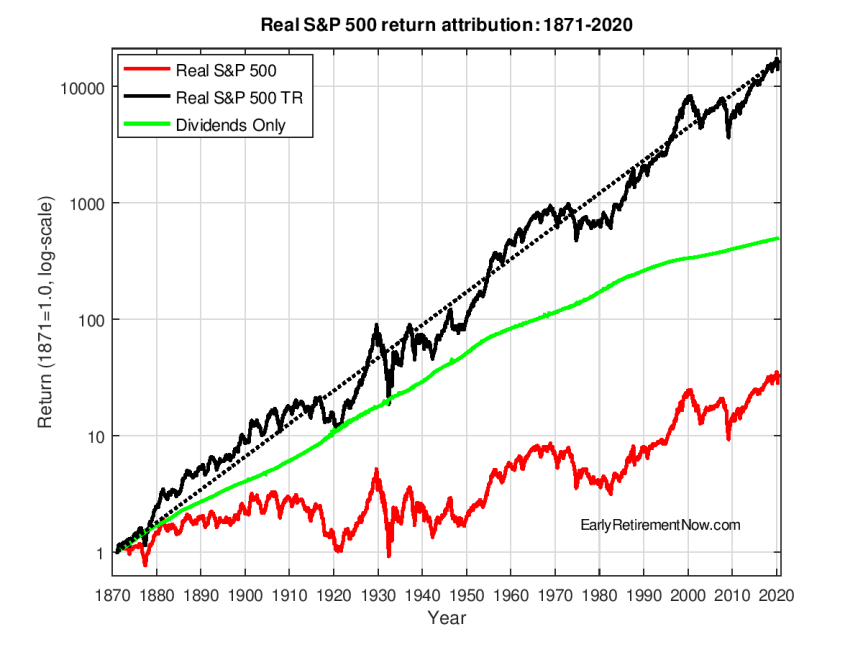

When dividends are lower, should we worry about lower expected equity returns, then? Not necessarily! If I plot the Total Return of the S&P 500 since 1871 in the chart below, the black line very closely “hugs” a nice exponential trend (about 6.7% p.a.) depicted as the dotted black line, which is a straight line when using a log-scale on the y-axis. So the fact that we have slightly lower dividend yields starting in around 1950 and much lower dividend yields after 1990 (when the green line grows much slower) did not impact the total return much. The lower dividend yield was simply offset by a faster price return.

Another way of driving home this point, let’s look at the attribution of annualized total real returns into price returns and dividends over four equal time intervals, each about 37 years long. Early on, almost your entire total return came from dividends and very little from price returns. Over the final 37-year window the attribution was exactly the other way around, and very intriguingly, the significantly lower dividend yield was more than compensated through a higher price return resulting in the highest total return. So, low dividend yields are not a troublesome sign per se. If corporations simply hold on to their earnings and reinvest them to grow future profits, that’s perfectly OK.

But this was just a side issue. On to the next point…

How volatile was the dividend income?

There isn’t one single way to answer this question, but let’s start with a time series chart of the real dividends, normalized to 1.0 in 1871. Notice how there has been an upward trend over the last 150 years but it was a bumpy ride. I plot this on a log-scale to make the relative changes comparable across time. It looks like the price for the higher dividend yield early on was much higher volatility in dividend income!

I also like to plot a “drawdown chart” of the real dividends, i.e., how far has the dividend income fallen since its recent, expanding window all-time-high. See the chart below. Before 1950, you had some nasty, prolonged (multi-decade) drawdowns. So, if you were unlucky enough to start retirement in 1910 or 1929, you’d have to severely cut your retirement spending. By about 50% and you wouldn’t reach the initial level for another ~20 years. Ouch!

The drawdowns in the second half were slightly more benign. Only about 20% down from the all-time high during the 70s and 80s. But it still took 20+ years to reach the old all-time high. The dot-com bust and global financial crisis had relatively benign and short drops in real dividend income. But also keep in mind that the dividend yield going into the dot-com bust was exceptionally low – just about 1%.

Next, let’s look at the actual volatility of dividend income. So, for every retirement start date, I look at the 30-year time series of their real dividend income and calculate:

- The volatility (standard deviation) of the level of real dividend income, expressed as % of the initial portfolio value to make this comparable across time.

- The volatility (again, standard deviation) of the 12-month changes in real dividend income.

Let’s start with the volatility of the income level. That’s what I plot in the chart below. You had some nasty volatility throughout the entire sample, but especially in the first half. Notice that the vol is measured as % of the initial portfolio value. So, with a $2m initial portfolio, each 1% of volatility means $20,000 standard deviation in annual withdrawals. Quite substantial! So, the price of not running out of money is quite steep. Instead of a stable and predictable retirement budget you would have faced some pretty scary uncertainty about your exact budget over time.

A similar picture emerges when looking at the volatlity of changes, in this case the change over 12-month windows. Especially during the first half of the sample, you had double-digit percent annual changes. Some even as volatile as the S&P 500 index itself. But quite intriguingly, the volatility was very low again for the retirement cohorts between 1950 and 1979 (which again means that the annual dividend changes were really subdued between 1950 and all the way to 2009!).

I also like to look at the worst 1-year drop in real dividend income. So, in other words, by how much would I have to tighten my belt over a 12-month period. That’s in the chart below. Again, some of the most painful declines occurred early on. In contrast, retirement cohorts during the 1950 to the late 70s era had extremely stable dividend income. And again, that means over 30-year windows. So only when the 30-year windows reached the Global Financial Crisis era did you experience 20+% declines again. And also noteworthy: after the Global Financial Crisis, we haven’t even seen any drop in the real dividend income. At least not yet, but that will likely change. Dividend income will likely display a slight drop by the end of 2021.

Case studies

Always very instructive: I like to look at some of the historical cohorts that were badly impacted by Sequence Risk:

- August 1929: The stock market peak (at a monthly frequency) before the Great Depression.

- December 1965: One of the worst historical retirement cohorts due to the lackluster market returns between the mid-60s and early 70s and then the 1970s and early 80s malaise.

- December 1972: The peak before the 1970s mess.

- August 2000: The peak before the dot-com bust.

- September 2007: The peak before the Global Financial Crisis.

Let’s see how your dividend income would have evolved over a 30-year retirement (or a shorter horizon ending in 2020 for the 2000 and 2007 cohorts), see the chart below. Well, slim pickings here. All five cohorts would have started retirement with unacceptably low dividend yields between around 1% and 3.3%. What’s worse, the real dividend income, relative to the initial portfolio value would have dropped even more. To only about 1% of the initial portfolio in the early-2000s and about 1.3% in 2008. So, you started with a $1m portfolio but you only consume around $10,000 per year? Sure, you’ll not run out of money in 30 years but a retirement budget that lean is a steep price to pay. You might as well go with a Trinity-style 3.5% safe withdrawal rate which would have been ultra-safe in each case.

How about if you were lucky enough to retire exactly 24 months before the five prominent market peaks? The results look a bit more promising, especially for the 1927 cohort. You would have started with an initial dividend income level North of 4% of the principal. And you would have dropped to below 4% of the original portfolio level only for a few years, only to recover to 5+% and even close to 7% later in retirement.

But for the other cohorts, it would have still been a very lean retirement strategy. Despite retiring well before the peak you had trouble reaching the “magical” 4% mark. If you didn’t have any supplemental income this dividend-only approach is not really workable.

Valuation Matters

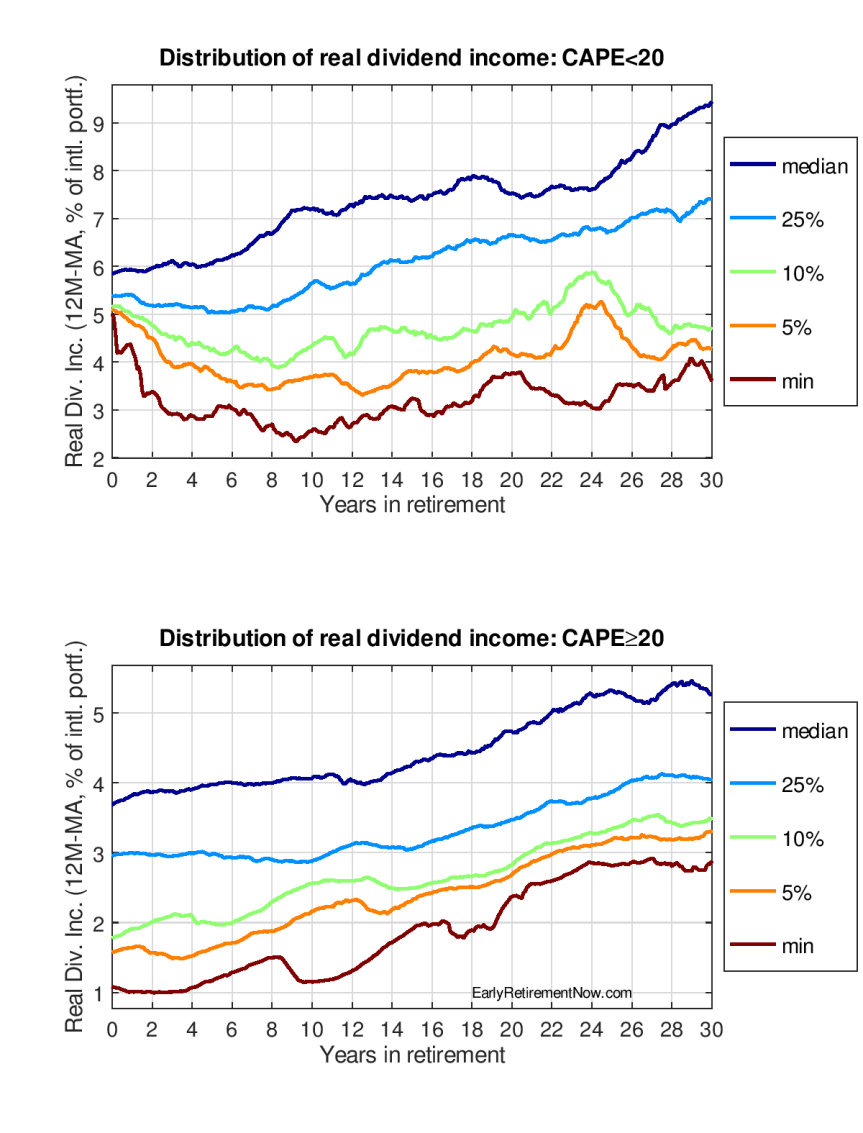

Another issue you’ll have trouble escaping with the Dividend-only method: equity valuations. Who would have thought?! In the two charts below are the percentiles of annual withdrawals (everything from the minimum to the median) over the historical 30-year windows, but I group the data into two bins: Once a low to moderate CAPE (<20) ratio at the beginning of retirment and once with the elevated CAPE ratios (greater than or equal 20). And results are pretty much as expected:

- If you retired when the CAPE was below 20, you could have started with an initial retirement budget of at least 5% or your initial portfolio. There was some possibility that you fall below that, even below 4% of the initial capital, but at a relatively low probability. So, the dividend strategy would have been completely managable and attractive in this environment. But keep in mind that the 4% Rule also never failed in history when the CAPE was below 20.

- If you retired when the CAPE was above 20, the dividend-only approach would have given you a pretty lean retirement. Even the median starts at slightly below 4%. And you have significant probabilities of some really, really lean retirement budgets along the way. It seems that this dividend strategy gets in trouble in the same environments as the naïve 4% Rule. So, we haven’t really found a hedge against Sequence Risk!

How about finding higher-yielding stocks?

Well, the S&P 500 is not yielding enough dividends right now and by the way, neither is the VTSAX/Total Stock Market Index, which is so popular in the FIRE community. Then how about focusing on higher-yielding stocks? Well, I thought I had already answered that question in parts 29, 30, and 31 of the series; higher dividend yield is not really a viable solution. You might even exacerbate sequence risk. Just to drive home that point, I created the chart below, where I plot the cumulative excess return of four dividend-focused ETFs over the S&P 500 total return index. The funds are:

- DVY: iShares Select Dividend ETF. Currently a 4+% yield. It also has the longest history of the four funds, going back to 2003!

- SDY: SPDR S&P Dividend ETF. Currently a yield just under 3%. Historical data go back to before the Global Financial Crisis.

- VYM: Vanguard High Dividend Yield Index Fund ETF. Currently a yield around 3.5%

- NOBL: ProShares S&P 500 Dividend Aristocrats ETF. Not much of a yield boost here. Only slightly above 2%.

Since they all have different start dates, they all start at 0% relative performance at their inception date and then run forward to September 2020. None of the funds outperformed the S&P 500. During the Global Financial Crisis and until about 2015, the three funds DVY, SDY and VYM had returns roughly in line with S&P 500. Some better, some worse than the broad index. Hence my verdict in the Yield Shield posts last year: higher dividend yield didn’t help you with Sequence Risk, but at least it didn’t hurt you either. But not so during the last five years and especially during the 2020 bear market. All the dividend-focused ETFs got completely clobbered, not just in absolute terms but also relative to the S&P 500.

Of course, the folks in the dividend crowd will always object that “smart investors” could have identified the “great” dividend stocks that do well and will never cut their dividends. To which I always reply with these three points:

- That makes you a stock picker and study after study shows that you can’t beat the market that way. Unless you believe that all the other stock pickers out there – large actively-managed funds, hedge funds, sovereign wealth funds, etc. – who all try to beat the market, somehow have never heard of the concept of a “dividend”. Nice try!

- But that said, you can certainly believe that you can beat the market by picking the “right” stocks. But then so can I: a portfolio with Google and Amazon (zero dividends) would have mopped the floor with your smart dividend portfolio over the last 10+ years. Hindsight is beautiful, isn’t it?

- Two of the dividend ETFs already do what folks in the “smart dividend” crowd claim will be the panacea: both SDY and NOBL identify stable and solid corporations that have a long history of paying, maintaining, and growing dividends. And they also lagged behind the broad index.

But again, I promised above that I don’t want this to turn into a hit piece, so I will stop here. I will save the real hit piece for a separate post. 🙂

Final verdict

I can certainly think of examples where LOYD/”live-off-your-dividend” works well. If you still have some income early in retirement – part-time work, the spouse still working, income from a blog, etc. – but you plan to slowly phase out that activity over the next 10-20 years then you can reasonably expect that your dividend income will eventually catch up with your needs. And you’d be able to leave a very nice-sized final asset value to your heirs. Much higher than the $0 target in the Trinity Study!

But for the rest of us, probably for most folks in the early retirement crowd who don’t have a six-figure income from a blog, the LOYD approach will likely not work in today’s dividend environment. The current S&P 500 yield, just under 2%, is too low and I don’t need to grow my nest egg anymore going forward. I’d much rather consume and withdraw a little bit more today and leave a smaller bequest to our daughter. I’d be completely content leaving “only” about 25% or even 10% of our current net worth to our daughter. That’s still a nice chunk of cash that will help her get a nice jump start in life but not enough money to turn her into a spoiled trust fund princess.

To conclude, most retirees will do better hedging against Sequence Risk through a diversified portfolio with somewhere around 60-80% equities and the rest in safe(r) assets; cash, government bonds, etc. But that said, keep in mind that a glidepath approach (see Part 19 and Part 20) has a similar flavor to the LOYD. Think of the bond portion as funding the difference between the dividend yield and your retirement budget early on. And by the time you’ve depleted the bond portion, the dividend income is likely high enough to (almost) fund your entire budget. So, the dividend approach works out in that way. And hat’s the perfect, nice conciliatory note to end this post today!

Another great article ERN. Many thanks.

By coincidence I’ve been involved, over the past couple of days, in an interesting thread on this very subject on a UK forum https://moneyforums.citywire.co.uk

I’ve added a link to your site, which I know carries a lot of weight this side of the pond. I’ll wait to see how the income crowd responds to your analysis.

Thanks for that Joe! And I will check out that forum. What’s the thread about that you posted on?

https://moneyforums.citywire.co.uk/yaf_postst10324p4_Why-do-you-invest-for-income–if-at-all.aspx

You get a mention at #76

Thank you, Joe! 🙂

“That’s still a nice chunk of cash that will help her get a nice jump start in life but not enough money to turn her into a spoiled trust fund princess.”

Will your daughter be well into her career by the time she inherits anything? If my parents kick the bucket at the average time in my family, I’ll be at standard retirement age! It’s already too late for an inheritance to give me a jump start 🙂

Very good point. So the jump start will likely involve some money transfers before we kick the bucket, i.e., college and maybe grad school paid for, help with a down payment, etc. After which she’s on her own. But maybe she will get a small additional cash flow when she’s 60. 🙂

Max makes an interesting point. I just finished reading “Die with Zero” by hedge fund manager Bill Perkins who tries to make the case that prodigious savers who may never outlive their retirement money should opt to giving it to charity or family when they most likely need it which may be now instead of upon death of the saver. Prof. ERN you appear to be planning on this by helping out your daughter as her life events occur. I ran your SWR analysis with various scenarios by gifting to our children up to the annual nontaxable amount. We still have nice nest egg left after our projected life span with very little risk. Since I am 61 and our three children are in their 30’s, we would want them to invest the annual gifts towards their retirement which gives them a longer time to grow it than I can due to my limited time left on earth.

Excellent point. It’s another reason not to rely on one flat withdrawal pattern over time. I’d like to give some early transfers way before we’re gone! 🙂

What if the dividend from vti/vtsax (2%) can cover your expenses? Would you say that probably should’ve retired a lot earlier?

That’s exactly right. You probably could/should have retired earlier and dig into the principal at least a little bit. 🙂

Prof. ERN, congratulations on reaching 40 twists and turns to your highly acclaimed SWR series. Thanks for all the enlightenment. For those of us not having enough in retirement to continue our quality life solely relying on dividends, we naturally need to live on some of our principal gained through thoughtful and meticulous savings. Nonetheless, the dividend analysis was once again wonderful and thought provoking. As one of your students, I would love to place an orange on your desk since I am in Florida and you being near apple country, you have all you need!

Haha, thanks for the kind words, Eduardo! Next time my daughter eats an orange (her favorite) I will toast to you and the beautiful sunshine state of Florida! 🙂

Great point about dividends making up a much smaller component of total return than in prior periods. The low dividend yield is likely related to lower bond yields as well, with stock prices bid up so that dividend yields more closely line up with bond yields.

On another note have you considered revisiting your expected equity market return assumption given strong S&P 500 returns in 2019 and 2020?

Very good point about the bond yields! Corporations have more leeway to reduce the payout ratio with bond yields so low.

Good point, I think I should revisit that equity market expectation post. I don’t think I have to lower the expectations too much, but definitely, the valuation measures look a bit worse now than in 2017.

Think of the current valuation measures as high inflation – not so much in consumer prices – yet – and some already in real estate prices, but intense inflation in stock and bond prices, due to the Fed trying to create wealth out of thin air by printing fiat paper currency. We all know that wealth has to be produced by the rational human mind taking action to create, not by printing presses…..Those Fed officials (e.g. Powell) and politicians have huge inflation-protected lifetime pensions, the net present value of which is millions of dollars apiece, which insulate them from their irrational polices that harm so many. The rest of us…..? That paper currency they print, not backed by anything tangible, has to go somewhere…..32x CAPE ratio???……0.75% 10-yr bond yields?????……..Venezuela here we (eventually) come….such irrational government policies….so sad for the future….but one thing is certain – the government bureaucrats, both elected and unelected, and the gov’t connected, gov’t employees, consultants, lobbyists, will live fat and comfortable off the work of the rest of us, whether it was in feudal England in 1000 A.D., with the peasants toiling outside the castle walls for the king and nobility safely ensconsed inside, or now in 2020 A.D., where we citizens toil and get hugely taxed and regulated to provide comfortable lifestyles for the government officials and those who are government-connected (gov’t union employees, consultants, lobbyists, etc.) – just look at the wealth on display in the suburbs surrounding certain areas of Washington DC. and Virginia, where they all live…..i’m trying to believe there is still some hope for the future…..but……………

Yeah, the incentives are definitely skewed. Government honchos seem out of touch with the concerns of normal Americans as can be seen with the COVID response.

I’m also very concerned about some of the Venezuela parallels (and don’t forget Argentina!) but cross my fingers and pray to The Lord that this nonsense will not move here.

excellent post, ERN!

Thanks, mario! 🙂

Ern,

Very interesting article, with some great graphs.

I guess if your annual need (expressed as a %age) is low enough then LOYD is feasible – however, your need has to be pretty low, unless as you point out, you can find a way to supplement the early [lean] years. Personally, I am not sure if I could ‘keep the faith’ for the required 10 to 20 years after jumping ship though!

Your comment “with somewhere around 60-80% equities and the rest in safe(r) assets; cash, government bonds, etc.” intrigues me. In todays environment what do you consider to be practical “safe(r) assets”?

Good point. “safe asset” is a term specific to the horizon. Bonds/Cash may be low risk in the short-term, as measured by volatility/standard deviation. But they pose great risks for the long-term & running out of money/purchasing power.

So, in this context, safe referred to diversifying the short-term equity risk/sequence Risk. 🙂

Thanks for the clarification.

And, if I may, a follow up: what are your views on practical safe(r) assets over the medium to longer term?

Safe over the long-term: equities and real estate. Not much else out there.

I consider the LOYD approach problematic because it is vulnerable to changing fashions in corporate management. For years we have had a trend of corporations increasingly using cash to buy back shares rather than pay dividends. This trend might just continue until dividends are next to nothing. Changes in tax policy have potential to accelerate the shift.

The dividend approach is a hold over from the days of high fixed commissions and broad bid/ask spreads. My Grandpa was a dividend investor up until his demise in the early 1970’s. It made sense for him because the trading costs to sell a few shares to “make your own dividend” were painfully high. Now with very narrow spreads and commission free trades, one can extract cash from one’s stocks very cheaply, or at no cost if unloading mutual fund shares.

Yes, great point! Back in the old days it wasn’t so easy/cheap to just liquidate some of the principal. So, corporations HAD to pay in dividends. Makes a lot of sense! 🙂

Thank you Big Ern for another great addition to the beloved SWR series. I also really enjoyed the podcast. I am one of the handful of people you mentioned who have implemented your options trading strategy. I agree it is not a necessary component to a successful FIRE strategy. In fact, I thought it sounded crazy when I first learned of it.

Now, 18 months after selling my first 2 DTE SPX put, options have become the most enjoyable and interesting part of my portfolio. Thanks for sharing this counterintuitive strategy for reducing sequence risk.

Thanks! This is in fact a nice income-generating strategy I can endorse! 🙂 Thanks for the feedback and good luck riding the 2020 volatility! 🙂

A very tax efficient incoming generating strategy as well. I keep my entire option trading account in VTEB (a Vanguard muni bond ETF). The IRS 1256 code tax treatment of cap gains/losses on index options also helps. I only fully appreciated how brilliant this strategy is after I filed my tax returns for 2019.

Awesome! Glad this works out well so far! 🙂

ERN it looks like what you’ve discovered is that a portfolio of NON-DIVIDEND paying stocks would vastly outperform a portfolio of dividend payers. That is, the SWR of a diversified portfolio could be higher if we removed stocks that pay a dividend.

This makes sense to me. To pay a dividend one must be both bad at the tax math (buybacks are more efficient) AND be unable to think of productive reinvestments of cash flow. These stocks are stinkers.

Is anyone aware of an ETF following a strategy of excluding dividend payers? Is there any way to model SWR following this strategy?

Well, well, that’s not exactly what I intended. Looking at the S&P returns it appears that “low dividends => high price returns” in the time series. That doesn’t necessarily imply that the same is true in the cross-section, i.e., across different corporations. I personally expect that total returns should be about in line with the CAPM regardless of dividend yield.

The fact that non-dividend payers outperformed recently is likely due to a sector effect (IT performing better), not necessarily due to dividends (or lack thereof).

I’ve proposed setting up an index fund as through 2 components: 1 component with low/no dividends and 1 component with high dividends. THen keep the former in the taxable account and the latter in the tax-deferred account. It would increase tax efficiency. See https://earlyretirementnow.com/2018/05/30/idea-for-a-new-etf/

But Vanguard hasn’t called me yet. 🙂

This is peripheral to this discussion however since the stock vs bond allocation is mentioned I will ask:

Why would anyone hold bonds vs cash these days?

Bonds offer a tiny extra yield (0.7% more compared to cash or even less if compared to CDs) with a lot of extra downward risk (if interest rates rise). Meanwhile the upward potential for bonds is minimal, perhaps 10-12% if interest rates peg all the way negative to European levels. It does not seem practically possible/enforceable to intensify financial repression into negative interest rates below -0.75% (otherwise the Europeans would have already done it). There is a negative interest rate floor below which cash starts being stashed in safe deposit boxes — or is there?

So, in summary, with minimal upward potential and big downward potential why would anyone hold bonds vs cash? Obviously the bond market has not collapsed so there must be some reason people hold bonds over cash but I cannot see any. And if I can still see some weak reason why an individual investor may hold American bonds at the paltry 0.7% rate with minimal upward potential over cash, I don’t see why individual Investors would hold European bonds at -0.5%

The recent COVID-19 correction seems to have demonstrated that long bonds still offer a outer-balance to equities in times of stress. Cash will not.

It proved that when the 10y safe government bond rate goes from 3% down to 0.7% then the value of the bond increases by about 19%. This calculation seems fairly predictable.

Similarly if the 10y safe government bond rate were to peg from the current 0.7% all the way down to the minimum possible -0.5% then the 10y bond may appreciate another 10%. But that’s it. That is all the appreciation potential that 10y government bond owners hold. Rates cannot possibly fall below -0.5%.

Yup, we probably have only a max of 100bps to fall. But that’s still an 8% gain in the case of a stock market collapse.

Well said! 🙂

Well, the appeal of 10y bonds at 0.7% is that if the crap the fan and the economy tanks yields will go down even more and you can benefit from the duration effect. Not saying that this will happen, but it would work as a hedge in that case.

I’m just wondering which average retired American will be willing to or able to plow through all the analysis. The reality is the vast majority of average folk want to know what there income will be each month. Why can’t they build up their retirement accounts and pick a few long-term dividend paying stocks to provide a steady income flow as well? And when we talk about withdrawal rates let’s not forget the IRS determines that at age 72.

The average retiree will not. But keep in mind that if you want a simple rule, like 3% dividend yield you’ll a) likely work way too long to accumulate that exaggerated portfolio target and b) have a potentially bumpy and volatile ride with your dividend flow.

So, I’m not arm-twisting anyone to read my stuff. But the readers of my blog will have a smoother, more confident, and more comfortable ride. For a time commitment less than what lots of folks spend researching a new car purchase.

Also, RMDs at age 72 will most definitely NOT DETERMINE your withdrawal rate. You might withdraw MORE than the RMD. Or you might withdraw the RMD amount but reinvest some of the unwanted funds, especially later in life. Or you might withdraw a lot due to RMDs in your retirement accounts and leave your other accounts that are not subject to RMDs untouched.

So, RMDs are not a very good guide for withdrawal rates (see my Morningstar podcast appearance for more info).

A pretty easy option for “average retired Americans” is to just do one of the target date funds with auto contributions while working and then auto withdrawals during retirement (<4%/ year). For a little more involvement, one could do a two fund portfolio with 60% stocks and 40% bonds and set up auto withdrawal to a checking account. One might only need check it once per year re-balance. No need to worry about companies cutting dividends like 63 of the S&P 500 companies did this year, which more than did in 2008.

ERN- Sometimes the Dividend Crowd’s argument can seem deceptively simple and safe at first glance. Thank you for writing this so we can see the full picture. I’m curious your thoughts on continuing the DRIP of index funds in retirement. You said in your conclusion that you “would much rather consume and withdrawal a little more today”. I took that as not reinvesting dividends from your S&P or Total Stock funds.

In retirement do you advocate reinvesting the current 2% dividends that index funds payout and only selling shares for withdrawal rather than using the dividends to supplement withdrawal and preserve some principle?

I’d use the dividends as retirement income first and then sell more shares (likely the highest cost basis) because, most likely, 2% dividend yield is not going to cut it for most regular retirees. 🙂

Dirk Cotton wrote a good and IMO very even-handed article on this subject a year or so ago, see http://www.theretirementcafe.com/2019/04/a-good-many-retirees-seem-to-be.html

As usual, the comments to the post help flush out some of the points – including the issue of choosing what to sell and, of course, when to sell it rather than “forced” sells at pre-determined dates.

Yeah, Cotton is a good guy! And I like that he linked back to my post dealing with the Yield Shield! 🙂

At the risk of asking a question that may have already been dealt with… here goes.

What are your thoughts on maintaining a fixed amount invested while skimming and spending the rest as the portfolio exceeds said amount during the year? We want to live and spend now rather than having a huge pile of cash at the end of our lives.

Assume the following:

> We’re retired

> Our portfolio has the ability @ 3.5-4% withdrawals per year to cover our expenses in a typical year

> Our emergency/spending stash is sufficient to cover at least 3 years of spending without touching the portfolio in a down year.

> The portfolio is invested about 60-40 equities to bonds.

If you have addressed this in your amazing SWR series please point me to the appropriate post. And lastly, thank you for the time and work you do to perform and post these enlightening analyses.

in Part 25 I addressed that in the section “cash bucket”:

“So, for the record, let me state that this cash bucket strategy seems to work pretty well, despite my previous doubts! It’s relatively inexpensive insurance against Sequence Risk! Think of it as a mini-glidepath during the first few years of retirement! And it “only” takes the flexibility of getting to 27.5x instead of 25x annual spending!”

Big ERN – Thank you for the article. I really enjoyed reading it.

A challenge for many early retirees to only withdrawing dividends from their portfolios, is that at retirement many of us have a substantial amount of our savings in tax deferred (i.e. IRAs). In order to access the funds in the tax deferred prior to 59 1/2 (and perhaps afterward if one is managing their MAGI for health insurance reasons), one either has take advantage of 72t -or- pay a significant early withdrawal penalty, both of which may result in withdrawing Principal in addition to dividends. One solution to this, is to over-allocate to fixed income in the taxable account, and draw down some of the fixed income each year, until one starts withdrawing from tax deferred accounts.

I believe that you have previously touched on this, but another challenge in today’s market, is that many dividend focused investors are over allocating their portfolios to higher yield investments such as those in the Energy, MLP, BDC, and CEF spaces. IMHO, many of the names in these spaces have a higher dividend sustainability risk.

If ALL of your savings are in the IRA/401k, then that’s a problem. But if you have a good account type mix you can first access only the taxable account and sell some principal there but reinvest some of the dividends in the inaccessible accounts. Money is fungible! 🙂

Utilising capital as income has always been a legitimate strategy for some investors and early retirees; however, it is a forced outcome for many who retired too early with too little. If you require a 6% income from your portfolio and the underlying investments are only yielding around 2% then inevitably the extra must come from your asset base. It is worrying to see that this strategy becomes more widespread in the FIRE community when bull markets are running. It is no use quoting a total return from equities of say 8% p.a. over the long term and then equating that as a potential income stream. As we come to accept rises in share prices as the norm, so we build new strategies around these perceptions.

The theoretical model of selling down shares in early retirement is sound, but I suspect many will struggle with the implementation. Those in the FIRE community suffer most from capital consumption. Should they no longer rely solely on the dividends? Should we tell them that selling shares would give a marginally better result? I believe this will provide more opportunity for regret. Many investors endure regret and, even worse, the fear of regret. Which shares should they sell? When is the right time? What if the market is flat? Should they wait until it comes back? What if it doesn’t?

It is clear that the one stable aspect of investing in good businesses is the long-term growing income stream. For many on the FIRE journey this has provided certainty and peace of mind in early retirement. Despite the theoretical attraction of capital consumption and as seductive as playing the market by buying and selling may appear, I think it is fair to say that market timing and liquidating equities is not much better than gambling for most of us. Remember, wealth creation requires time and patience. The faster we want to make money, the greater the risks we must take.

The value of my portfolio, whilst not irrelevant, is of little importance on a day-to-day basis. I have lost nothing by not selling. In fact, the people who lost the most were those that did sell as they panicked and fled. As the past demonstrates, although there was a dip in dividends in the midst of the GFC turmoil, I am now looking back on several years of increasing income.

As time passes, the risk with shares diminishes. When we diversify and our capital is returned in dividend payments, any short-term fluctuation in my asset base is a non-event. My life and early retirement is now secured, and many options become available to me.

What is the best advice for people who have recently retired, or who plan to retire early in the near future? 1. Maintain a long-term investment in dividend-paying shares. 2. Stop watching share prices. 3. Enjoy life and your financial independence.

Thanks for sharing this. Very nice read and very keen observations on the pros/cons of capital consumption!

It takes some guts to liquidate the principal, that’s for sure. For people who can’t stand this thought, maybe invest in real estate and live off the rents only!?

The calculations and charts are beyond us mere average folk. If I invest all during my working career (long over by the way) and reinvest all dividend and interest along the way and then calculate my income needs after SS benefits and conclude that dividends can meet that need, what is wrong with following that strategy for a long as possible, especially if say 35% of my income is COLA adjusted SS. When it no longer is sufficient, I start taking withdrawals as necessary, but in those years can I not assume that the underlying values will increase? Of course, I am talking about retiring at a normal age not 45 or so.

If your dividend income is sufficient for your cash flow needs then you’re in good shape. It means you probably accumulated too much because your equity portfolio without dividends will likely keep growing in retirement. Your heirs will thank you! 🙂

“phase out that activity over the next 10-20 years then you can reasonably expect that your dividend income will eventually catch up with your needs”

I believe that investors 10 years away from retirement with a portfolio large enough in which current yield from ETFS like VYM or SCHD would generate enough income if yield on cost would grow to 6% in 10 years, could easily draw income only from a dividend portfolio with a high chance of keeping up with inflation while keeping the principal intact.

For example a $700K portfolio 10 years prior to retirement could be invested in SCHD with expectations of generating $50,000 of dividend income 10 years later.

Incidentally, the yield on cost for SCHD is 5.6% if purchased this ETF just 5 years ago. So, you will have plenty of cushion in case this ETF suffers a dividend decline.

This way, you don’t have to worry about reaching a specific portfolio balance just in time of your retirement. You just count the income.

Yes, that’s exactly my point. Your current Div Yield income may not be quite enough, so maybe you still work part-time or you run a blog or consulting business. But then over time, your dividends grow at 3-6% real and this will get you to your target.

But you’d still be scared of a 1930s style recession and sharp cut in dividends or a 1970s style drop in REAL dividends due to an inflation shock! 🙂

I get it. My issue is that we have possibly saved too much. I have been trying to follow Skylars (and also Dave van Knapp) idea with SCHD in the ROTH portion of our portfolio. The goal being to get the yield on cost up to 10% in 10 years (in 10yr., 200k yields 20k if left and div and growth allowed to compound).We have enough with our SS, 2 small pensions and my taxable IRA. The issue becomes in a good market and even a market that goes no where and RMDs. They just kill ROTH conversions because the money comes out first and if you are not working you also can’t contribute to a ROTH. The other issue is the coming sunset in 2025. Could you talk about how 2025 could be worked around? After all in the lower tax brackets we go from 10/12/22% to 12/15/25(I think) and most of us in retirement don’t have deductions (mortgage interest) even to make the std deduction. So the sunset affects all in retirement.

I suspect that the tax cuts will be preserved for the middle class (<$100k income). So, I'm not too worried about the 2025 cliff. But to hedge against worse outcomes, it's certainly a good idea to a) move to a zero tax state and b) perform aggressive Roth conversions now up to the top of the 12% bracket, maybe even into the 22% bracket.

I guess I’ll never really understand why someone would risk all your hard earned money by going 100% equities, unless, well, it wasn’t hard earned !

Well, the simulations and optimization results ARE the reason. You may use a much lower equity portion if you are really risk-averse. Accusing others who not as risk-averse of not having earned their money is not really helpful in advancing the discussion.

I guess I’ll really never understand why someone would risk your hard earned money by going 100% equities, unless, well, it wasn’t hard earned !

“I’d much rather consume and withdraw a little bit more today and leave a smaller bequest to our daughter. I’d be completely content leaving “only” about 25% or even 10% of our current net worth to our daughter. That’s still a nice chunk of cash that will help her get a nice jump start in life.”

Genuinely curious: Judging by some of your SWR posts let’s say you are somewhere in your 40’s. Let’s also say that you plan for a 50 year retirement (judging by some posts), effectively living into your 90’s. How on earth is leaving ANY money to your daughter going to “help her get a nice jump start in life”? Scenario: you waited until 33 to have her, and you live until you are 93 (for simple math). That means she would be 60 years old by the time you leave her that 10% of your net worth. Feel free to adjust the numbers to your situation.

I can’t see how leaving money to someone in their 60’s is of any benefit. Unless they have been severely unfortunate in life, or have been severely poor managers of money. In the former case some money would help (but it likely would have helped more given in small amounts earlier). In the latter case giving them any money will not help as they are poor money managers in the first place. If this is the case you would be better off paying for financial education for them.

I extend this line of thinking to all charitable giving, and other financial bequest planning. Money today properly utilized by the receiver is of greater benefit and importance than money 50 years in the future. Thoughts?

Yes, good question.

We will provide a jump start to our daughter’s life well before we die.

There is no need to consume only the dividends and then leave $10m+ to our daughter when she’s 50-60. It’s better to live and to give before she’s 60. That’s what I argue on the article.

Just my 2 cents. Totally agree with Total Return approach, even in retirement. This why I own actively managed funds that focus on Total Return. Total return since 5/31/2021, PVAL inception: PVAL (+60.2%), VYM (+39%), NOBL (+18.4%), SDY (+17.1%).

Yeah, the high-dividend funds have lagged, for sure. And they don’t even offer much protection in a really bad drawdown either. See 2008-2009. I wrote about that cautionary tale in parts 29+30+31.

Another great piece ERN, thanks for sharing it. I did have two clarification questions:

1. What if you split your portfolio between 10% fixed income, 50% broad index fund, 40% dividend ETFs/stocks? Do you think this would improve outcomes by diversifying between both growth and dividends? e.g. consume dividends first and, if necessary (e.g. due to a dividend cut, or your expenses being greater than the dividends) then fund the rest with sales of your equities

2. If you focus on the total return approach and fund your expenses via sales of equities, would you not eventually run out of things to sell when you have no more equities to sell if you live long enough?

To be clear, I’m not doubting any of your results above! I’m just trying to make sure I understand correctly.

I’ve detailed my concerns about dividend-stock ETF in parts 29,30,31. They have expected returns roughly equal to the overall market (all else equal, i.e., market beta).

I like the idea of having a buffer of fixed income (especially in today’s interest rate environment) and deplete that while leaving equities untouched. But that would take 30-40% fixed income to fully hedge the first 10-15 years. That’s essentially a glidepath. See parts 19-20.

I have taken a similar approach but I allocate a lot more to bonds. I believe in reverse glide in which your stock allocation should grow as you age. As bonds mature in my deep years, I will have fewer years remaining to fund. So I don’t mind reinvesting maturing bonds into stocks.

I use TIPS as well to keep the principal from erosion to inflation.

The dividend strategy I use is higher yield (above 3%) mixed with low 2% that have some pop in dividend growth.

The combination of owning individual treasuries plus corporate bond ETF plus muni bond ETF plus a deferred income annuity and my social security income cover all of my necessities. The DGI allows me to grow my income a little while I wait for bonds to mature.

I also believe in a smile approach to expenses; whereby we will start with high spending that will decline over time and if one of us lives too long, then allow for expenses to rise.

Any liquidity event like life insurance proceeds, downsizing our house, or Roth conversions will all be allocated to 75% stocks because these events will happen where my life expectancy will be short.

Yep, that’s the glidepath idea. I mentioned it in the reply to the other guy. Nice idea!

First of all, thanks for the great articles. I learned a lot, reading up to here and there is much more to come, so much appreciate your effort in creating and maintaining the block and most of all, answering to questions. I learned from your answers as well.

I would like to ask you regarding the dividends. Are the charts above based only on the % dividend yield or you have taken into consideration the real distributed dividend as money?

I am asking, as I have made research on S&P etf and specifically for the amount of the dividends on yearly basis. For the period since 1991, the real distributed dividend were constantly increasing (except for 4 or 5 years). The biggest drop was for 2 years, during the Great Recession 2008 and 2009 (from dividend perspective). For almost all other years the dividend was increasing with average of around 6% or something around that.

My point is, if your calculations are based on the % dividend yield, with increasing/decreasing of the price of stock, the % could change a lot, however if the real distributed money continue to be in increasing trend (and beating the inflation), it is all good and won’t matter of the div yield is 5% or 1%, as long as it is increased with higher percent from last year + yearly inflation.

Each chart refers to exactly what it says in its title. Some are about the % yield. Some are about the $ income amount (CPI-adjusted).